By Mitchell Vexler, December 9, 2024

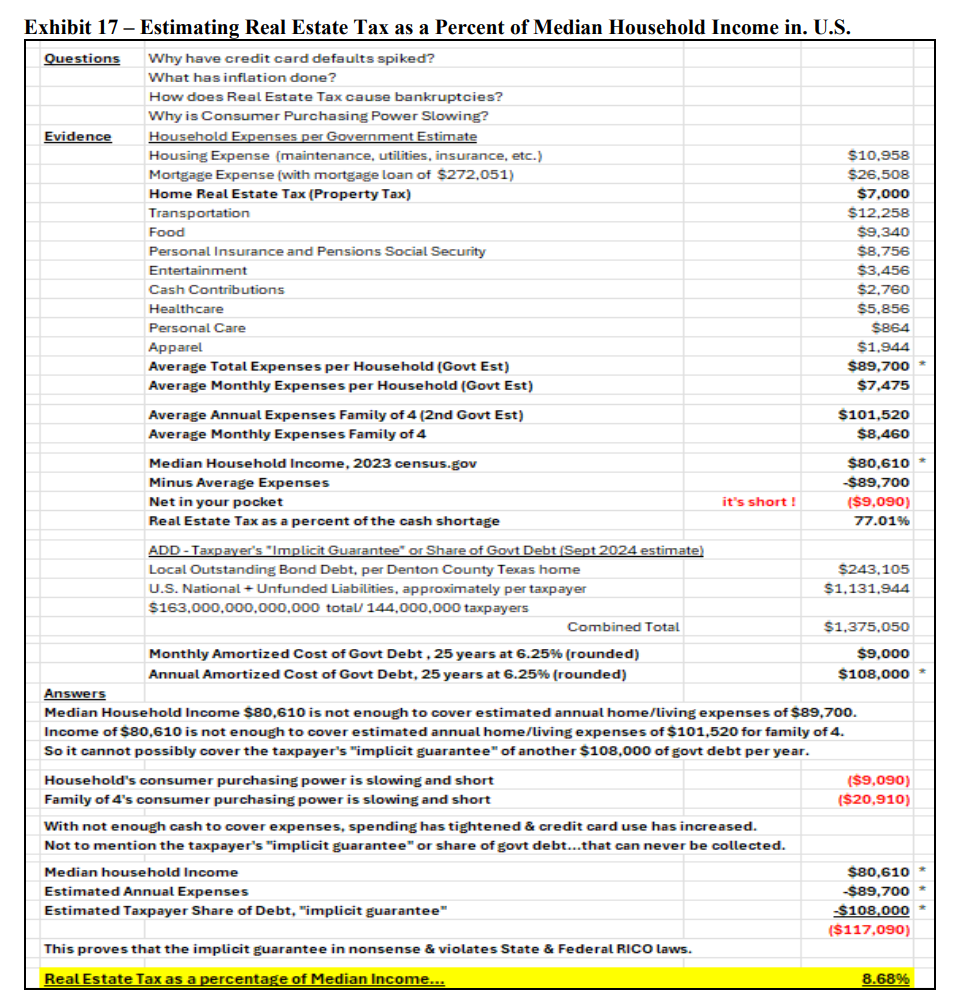

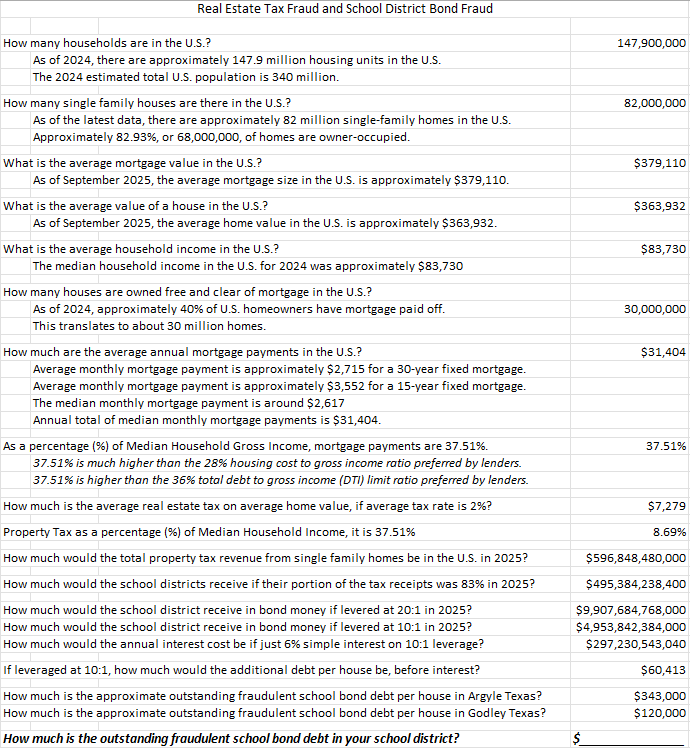

Following the last article that I wrote on Homestead and Circuit Breakers now comes more proof of fraud on a mass scale. I asked in one of the videos a very specific question to Mr. Don Spencer, the Chief Appraiser in the Denton County Central Appraisal District. Knowing, based on irrefutable evidence as found at www.mockingbirdproperties.com/dcad, that the real estate tax laws are being violated not just in Texas but in any County or Province that claims to use Uniform Standards of Professional Appraisal Practice, the question was, Mr. Spencer, what is to stop you from raising the real estate tax to infinity in 2025? The answer, by virtue of violating USPAP, is nothing. (See our violations reviewed pdf document.)

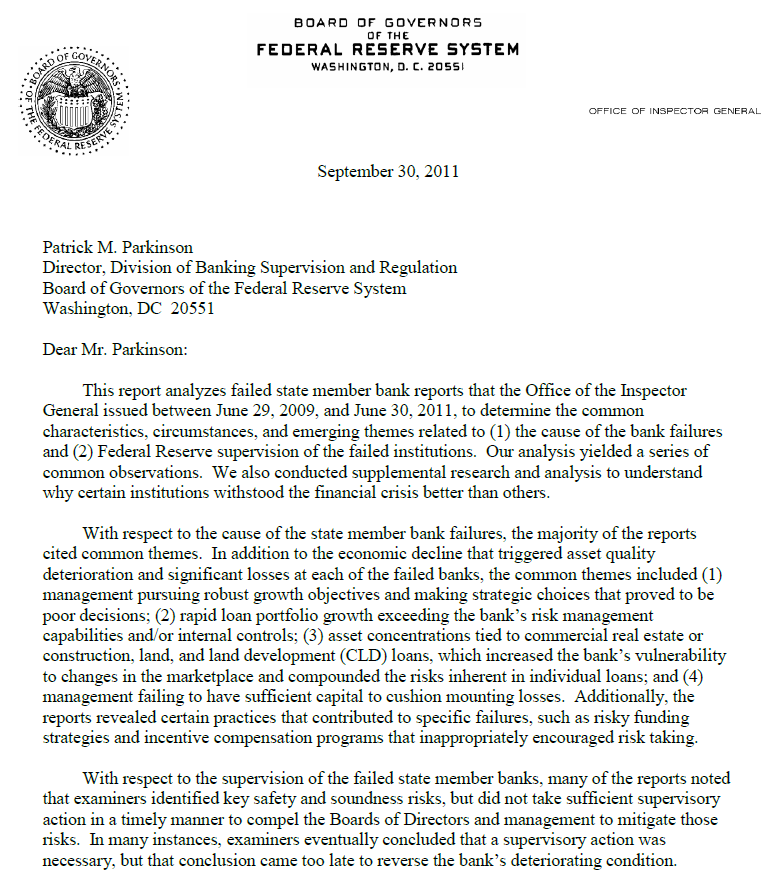

Now comes Central Illinois real estate tax, wherein an attempted theft of approximately 1,400% more in taxes for 2025 was on the table. Given the mountain of evidence, I was right to ask Mr. Spencer the question, and now can clearly show that the real estate tax across the U.S. is void of any associated appraisal law which creates such fraudulent overvaluation and resulting over taxation that it backs up all the evidence of fraud on a mass scale as I have been explaining. What is shown in the Illinois article, is that every real estate tax law is being broken, along with State and Constitutional law, all outside the confines of any law, licensing, and oath of office. It would indicate that given so many laws are being broken, that the possible solution would be a lawsuit against every single person who participated in the scheme to defraud the public. Depending on the legislatures of the various States to fix the problem has a low probability of success as compared to filing suit against the co-conspirators joint and severally liable.

Further to the filing of our Brief to the Appellate Court in Fort Worth last week, can you imagine if the Appellate Court (although not likely) rules that the case cannot move forward? Then The State of Texas A.) would have violated its own Constitution setting up a direct challenge at the U.S. Supreme Court B.) violated the 5th and 14th Amendments to the U.S. Constitution under Due Process C.) clearly demonstrated that there is no law to protect the Citizens from what becomes civil forfeiture via the fraud of overvaluation and over taxation, and D.) if there is no law, then why would anybody pay real estate tax???

The co-conspirators across the U.S. have moved the greed and abject theft so far that they proved the entire system is fraud.

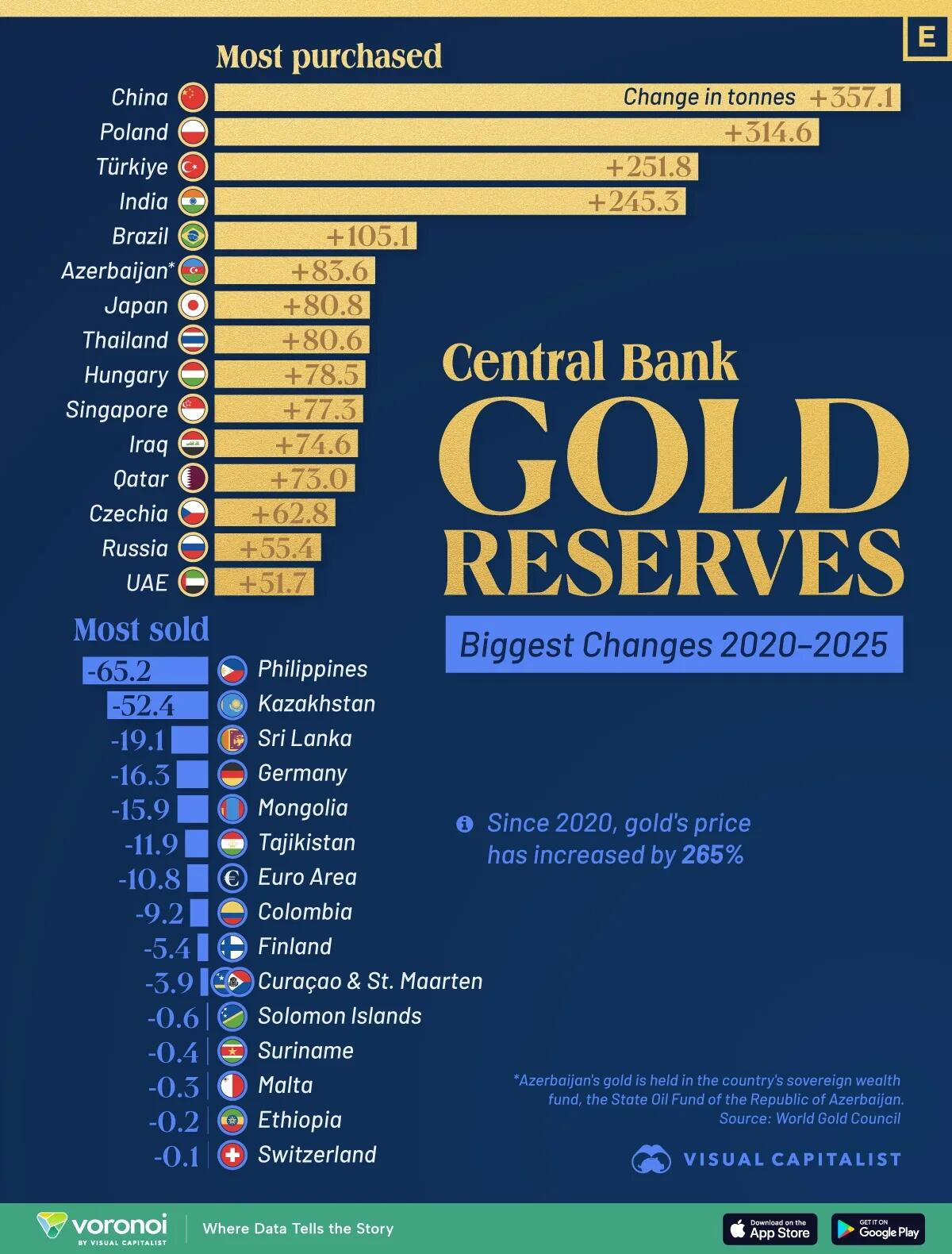

To be clear, Illinois is bankrupt as there is not enough money anywhere to cover-off the State’s pensions, liabilities, and unfunded liabilities. Stealing money to cover-off the sins of the politicians will end badly, which is why I keep stating that debt workouts are necessary to avoid chaos.

When a politician tells a taxpayer their $756 bill in 2024 will go up and be a $10,000 bill in 2025, there is a high probability that chaos will ensue.

See “illinoispolicy.org” news article below:

Residents in Central Illinois are feeling sticker shock from exponential property tax growth. One woman’s $756 property tax bill is skyrocketing to $10,000 in one year.

Residents in Montgomery County are seeing property tax bills go up by as much as 1,400%. One resident’s bill ballooned from $756 to $10,000 in one year.

That property owner, Brandi Lentz, started a Facebook group to for the community to share their stories, frustrations and what they can do about it. A County Board meeting Nov. 20 was standing room only, drawing over 300 residents and spilling into adjoining rooms.

Montgomery County Assessor Kendra Niehaus said the increase stems from a 2007 law signed by then-Gov. Rod Blagojevich, which is only now being enforced. The $10,000 bill and others aren’t because of mansions, they are because of trees. The law changed the way wooded areas are assessed.

A group of state lawmakers representing parts of Montgomery County have spoken out, saying the County Board needs to step in to rectify the massive hikes.

“There’s counties all over the state that are doing this differently,” said state Rep. Blaine Wilhour, R-Louisville. “Montgomery County can do the same.”

Illinoisans live with the second-highest property taxes in the nation. The median property tax bill in Montgomery County was $1,745 in the 2022 tax year, up $262 from 2018.

The county has fewer than 30,000 residents and is mostly agricultural. It is about 70 miles northeast of St. Louis on Interstate 55.

State lawmakers have regularly wrung their hands about the property tax burden, forming a state task force that failed to deliver any solutions and passing laws that nipped around the edges of the problem. If they want to get serious about the ever-increasing tax bills homeowners are seeing, they need to finally address the unsustainable cost of public pensions through meaningful constitutional pension reform.

Anything less will leave taxpayers lost in the woods.