Circuit Breaker & Homestead Exemption…

more fuel to the fraud fire.

By Mitchell Vexler, December 9, 2024

These concepts are more fuel to the fraud fire.

Circuit Breaker Limitation and Residence Homestead are examples of illegal regulations written by the Texas Legislature and exist both in temporary status with expiration dates and subject to amendment, to cover the fraud created by the Central Appraisal Districts on behalf of their owner the Taxing Entities.

There is a big list of various exemptions available. See page 670 of 2843 from the 2024 Certified Totals Report with G01-Denton County Grand Totals’ Exemption Breakdown. And then there are also reduced ag valuations that are not reported as exemptions but as “productivity losses”. There would be no need for any of these layered contortions (“exemptions”) to steal money if true market value as initially conceived was adhered to under the law. The Circuit Breaker and Homestead Exemption both exist as further proof of the valuations being created outside the confines of Texas Law being Uniform & Equal under Texas Constitution and outside of USPAP under the Texas Property Tax Code, and as violations of the 5th, 14th and 16th Amendments to the U.S. Constitution, not to mention RICO.

Leaving aside the illegality of the real estate tax “market value” under the 16th Amendment to the U.S. Constitution, neither the Circuit Breaker or the Residential Homestead would exist if properties were being valued (i.e. true market value) based on the price paid wherein under appraisal law, there is a willing buyer and willing seller, neither acting under duress, for a cash settled price.

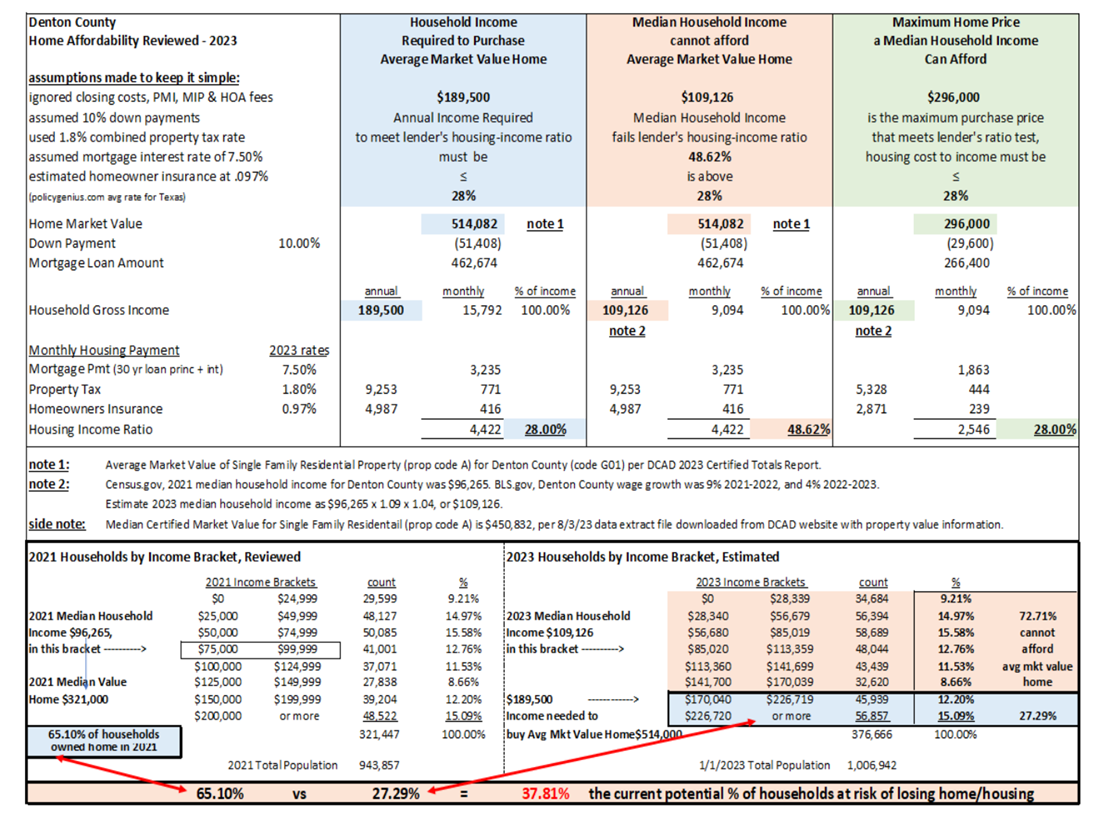

The Circuit Breaker 20% increase limitation generally applies to non-ag land property & non-homesteaded property with values under $5,000,000. The Residential Homestead limits annual assessment value increases to 10%, and in 2023, the tax exemption/exclusion amount for school taxes was bumped up to $100,000. These limitations, exemptions, and exclusions were created by the Legislature in reaction to the public’s cries and concerns on rising property taxes and to make it appear that the Legislature was doing something about the mass overvaluation and mass over taxation, neither one of which are legal and both of which violate Texas Property Tax Code and the U.S. Constitution.

In law, selective enforcement occurs when government officials exercise discretion, which is the power to choose whether or how to punish a person or corporation. The biased use of enforcement discretion, such as that based on racial prejudice or corruption, is usually considered a legal abuse and a threat to the rule of law.

The dangers of selective enforcement lie in its potential to undermine the fundamental principles of justice and equality. When laws are enforced inconsistently, it can lead to arbitrary outcomes, favoritism, and unequal treatment under the law. Individuals from marginalized communities may face harsher penalties, while others escape accountability due to their social status or connections.

Equality before the law, also known as equality under the law, equality in the eyes of the law, legal equality, or legal egalitarianism, is the principle that all people must be equally protected by the law. The principle requires a systematic rule of law that observes due process to provide equal justice and requires equal protection ensuring that no individual nor group of individuals be privileged over others by the law.

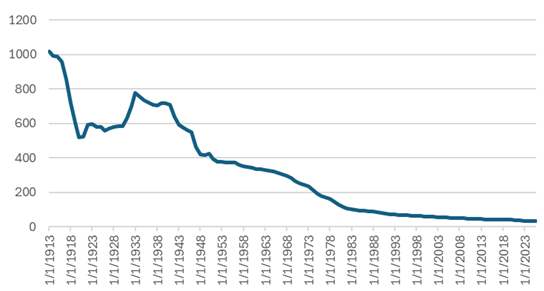

My Accountant has been tracking the property tax appraisal values on 140 shopping centers for the past several years. In 2024, at least 82% of them protested and another 9% would have filed a protest if their taxable value had not been limited by the Circuit Breaker. Compare this 82% plus 9%, or 91%, in 2024 with 2023’s 91% and 2022’s 92% and one can see that the protest case workload decreased by the 9% in this group due to the circuit breaker temporary rule, but the flagrant overvaluation practice remained unchanged as the effective protest rate stayed the same at 91 or 92%.

We have also been tracking the cost of multifamily in today’s market wherein the cost to build is in excess of $300,000 per unit. The Homestead Act does not apply to multifamily which can only be seen as pure prejudice against multifamily renters who pay the real estate taxes included in their rent. Why is it that multifamily (MF) tenants do not receive the same benefits as a single family (SF) homeowner? This is selective enforcement and or straight prejudice as both SF and MF pay real estate tax, yet only one group, being the SF, has a homestead exemption.

Nowhere inside of USPAP are the words “Homestead” or “Circuit Breaker”. Nowhere inside of Mass Appraisal Standards are the words “Homestead” or “Circuit Breaker”. The Texas Property Tax Code requires adherence to Uniform Standards of Professional Appraisal Practice and Mass Appraisal Standards.

Also, with regard to commercial property appraisals, whether the circuit breaker limitation is available or not, nowhere in USPAP does it say that income, expenses, net operating income, and cap rates should be manipulated to achieve the desired inflated appraisal value, but the Denton Central Appraisal District annually uses their income calculation worksheet as the device to steer and manipulate commercial property appraisals upward.

The Texas Constitution requires Uniform and Equal.

Ambiguity in contract provisions are usually resolved by the golden rule:

Determine the ordinary and natural meaning of the words used.

Consider the context of the contract including its purpose, any "recitals" or "background" clauses and other relevant provisions.

If the ordinary and natural meaning is inconsistent with the context or gives rise to absurdities, modify the meaning as appropriate.

In the vast majority of cases, this approach will give a meaning the court adopts without needing to invoke the contra proferentem rule.

However, in the minority of cases where the rule is applied it works like this. The ambiguity should be interpreted against:

the party who prepared the contract (particularly offered on a "take it or leave it" basis)

the party seeking to rely on the ambiguous position (e.g. the beneficiary of a guarantee, indemnity, limitation or exclusion provision).

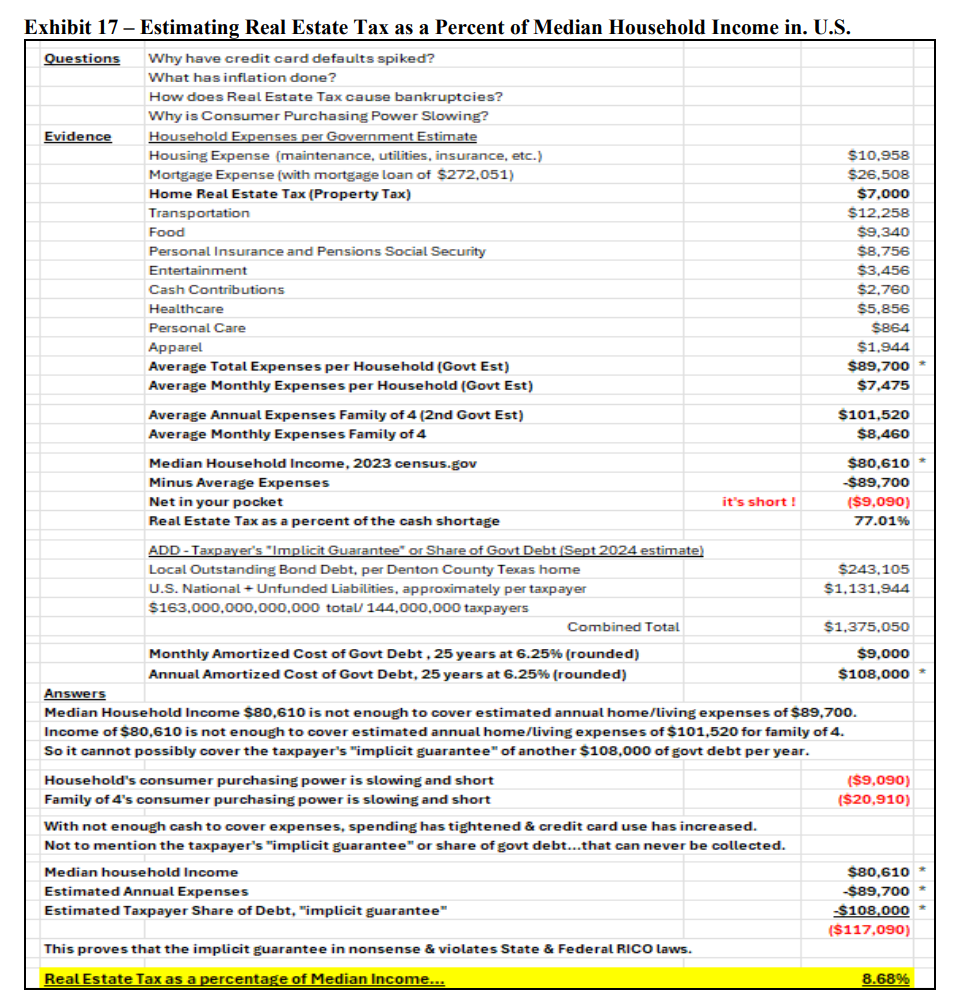

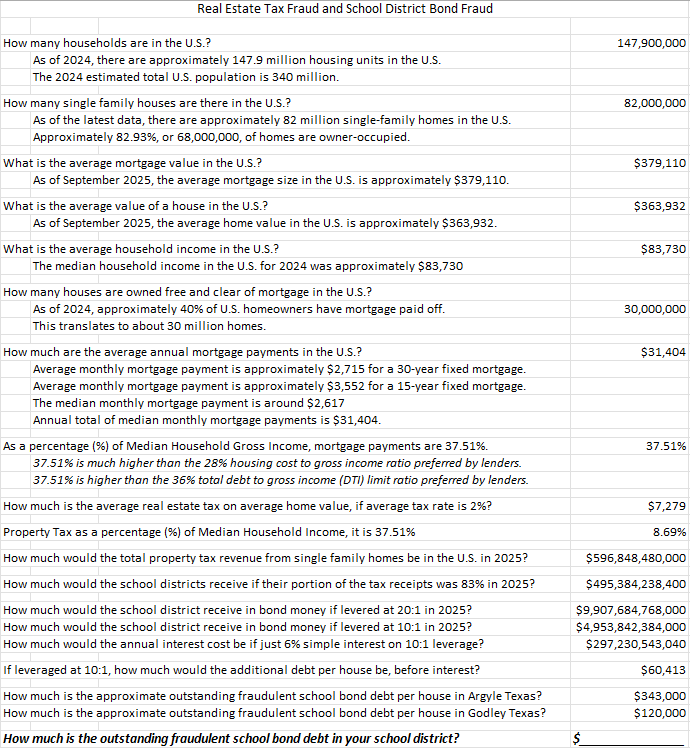

At a minimum both ambiguity and selective enforcement have been created in that the Residence Homestead and the Circuit Breaker are not applied for the benefit of all real estate taxpayers, violate both State and Federal Laws, and are prejudicial to all Texas multifamily real estate taxpayers (Tenants). The Texas Legislature wants its cake and wants to eat its cake, that is, provide cover to the Taxing Entities, but in such pursuit, has violated their own legislation thus creating Ambiguity and Selective Enforcement. Ambiguity must be read against the party seeking the restriction and that is the Texas Legislature itself as its own documented alleged law (“must adhere to USPAP”), violates another alleged law (Homestead). These alleged laws counteract each other, neither one of which would exist but for the attempt to cover up the continued fraudulent price increases of real estate to obtain higher tax revenue for the Taxing Entities, where the school districts receive roughly 83% of the bond money raised, all premised on the fraud, being the overvaluation and resulting over taxations at the hands of the Central Appraisal Districts and a host of co-conspirators such as the Chief Appraisers, the Board of Directors, and those who signed an Oath, all of which should be prosecuted and their pensions stripped.

Reference:

Texas Tax Code, Section 23.231, Circuit Breaker Limitation on Appraised Value of Real Property Other than Residence Homestead:

Texas Tax Code, Section 11.13, Residence Homestead: