Is This Sustainable?

By Mitchell Vexler, October 12, 2024

In reviewing the multitude of issues that we discovered or encountered with property tax appraisals and the protest/appeal value process in the Denton Central Appraisal District, one cannot help but stop and say, how is this sustainable?

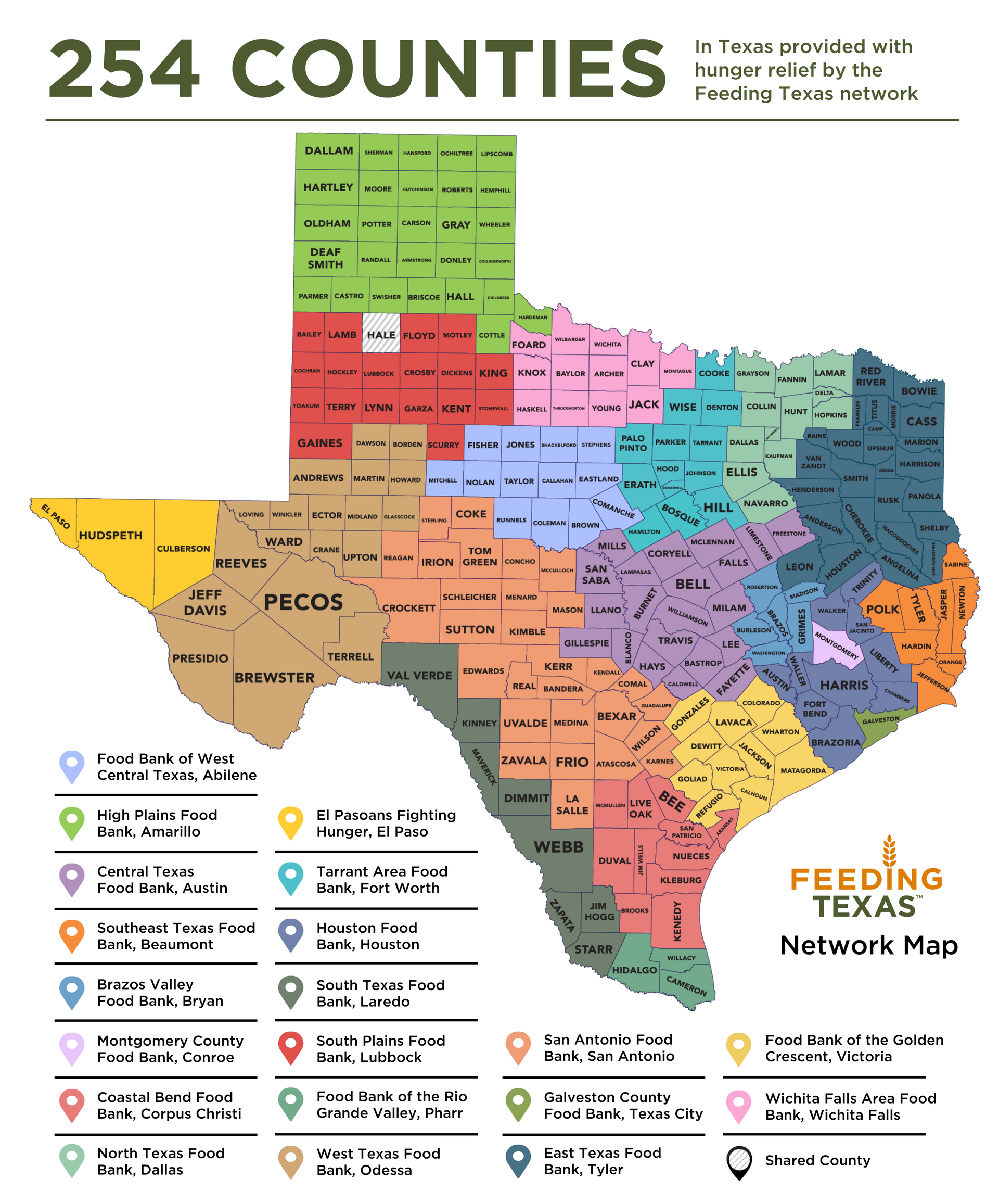

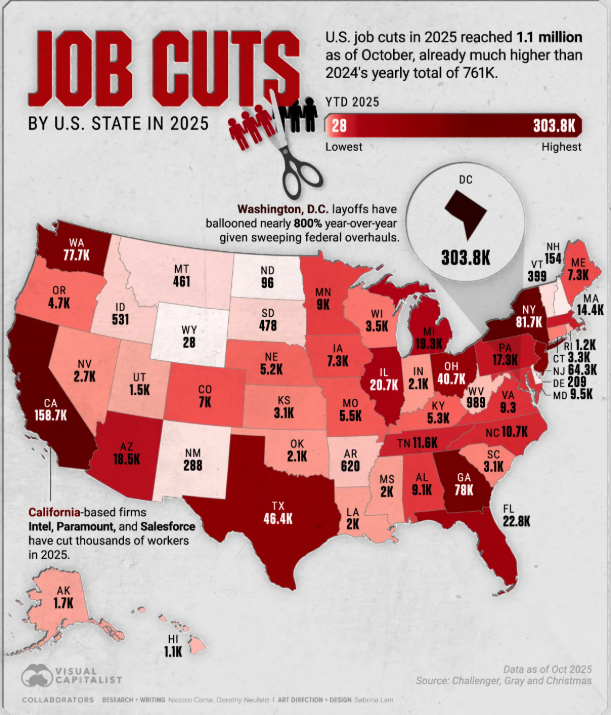

Can property owners in other appraisal districts across Texas, or across the U.S., survive this equity stripping attack?

And so, regardless of the geographic minor variances, is the following sustainable?

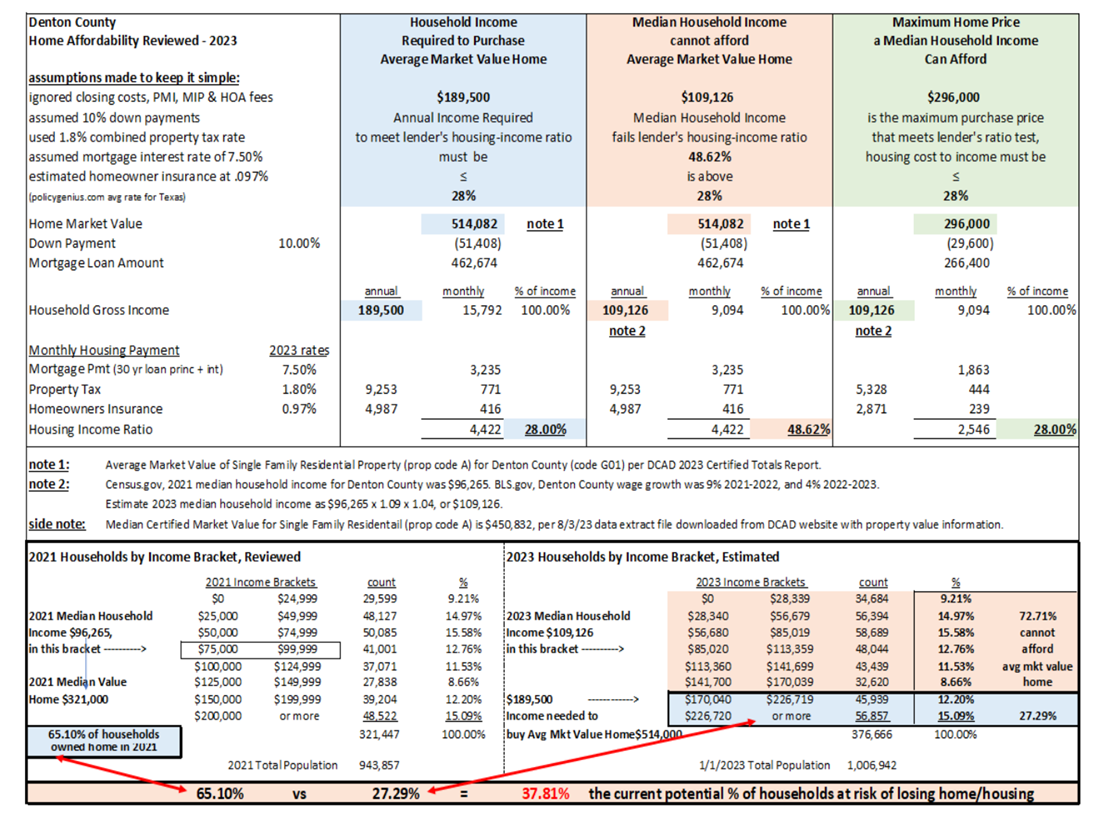

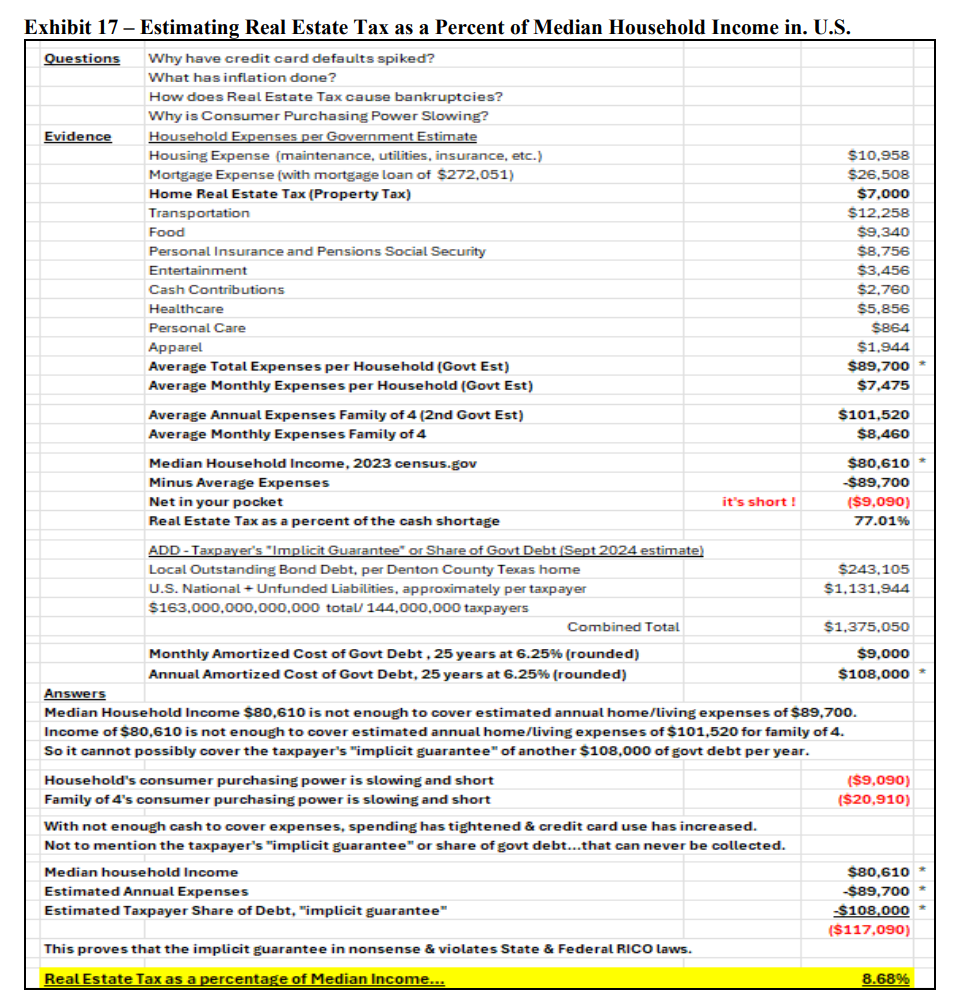

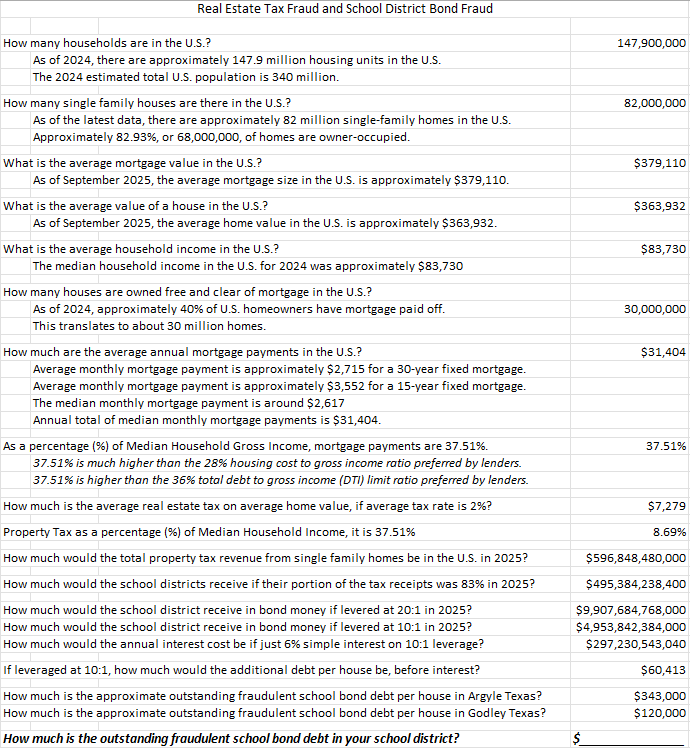

- 72% of the current homeowners cannot afford the deemed Median or Average Home Value in their area.

- 37% of the current households (multifamily & single family) are at risk of losing their home.

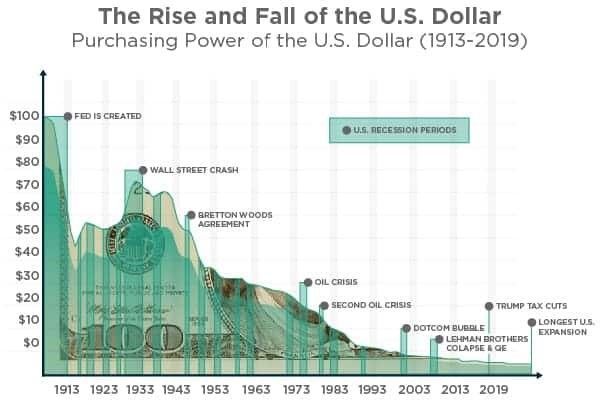

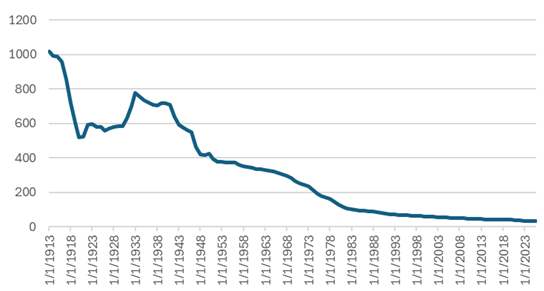

- Many single-family home property taxes and or tax appraisal values increased by over 60% in 2024; CAD’s property values increased 4 times faster than inflation since 2017.

- Single-family home property tax appraisals increased almost 3 times faster than inflation since 2018.

- Fraudulent Initial Notices of Value have been issued creating 200% to 320% increases on commercial property values.

- Central Appraisal Districts (CADs) are violating USPAP.

- CADs are violating State’s Property Tax Code.

- CADs are violating State’s Constitutions.

- CADs are violating U.S. Constitution.

- CADs are lying to the ARB panels.

- CADs are violating IAAO.

- CADs are violating Mass Appraisal Standards.

- CADs are manipulating property data and manually overwriting/overriding their CAMA software.

- CADs are creating databases that are over 76% corrupted.

- 74% of the certified average home values are overvalued based on affordability; in 2023 Denton Central Appraisal District’s average home value was 74% higher than the affordable home value based on the county’s median household.

- Average home property tax appraisal market value increased 62% from 2020 to 2023 (Denton Central Appraisal District $316,751 vs $514,082).

- ARB panels are doing the bidding of their masters (the CADs).

- Communities are being targeted for higher overvaluations.

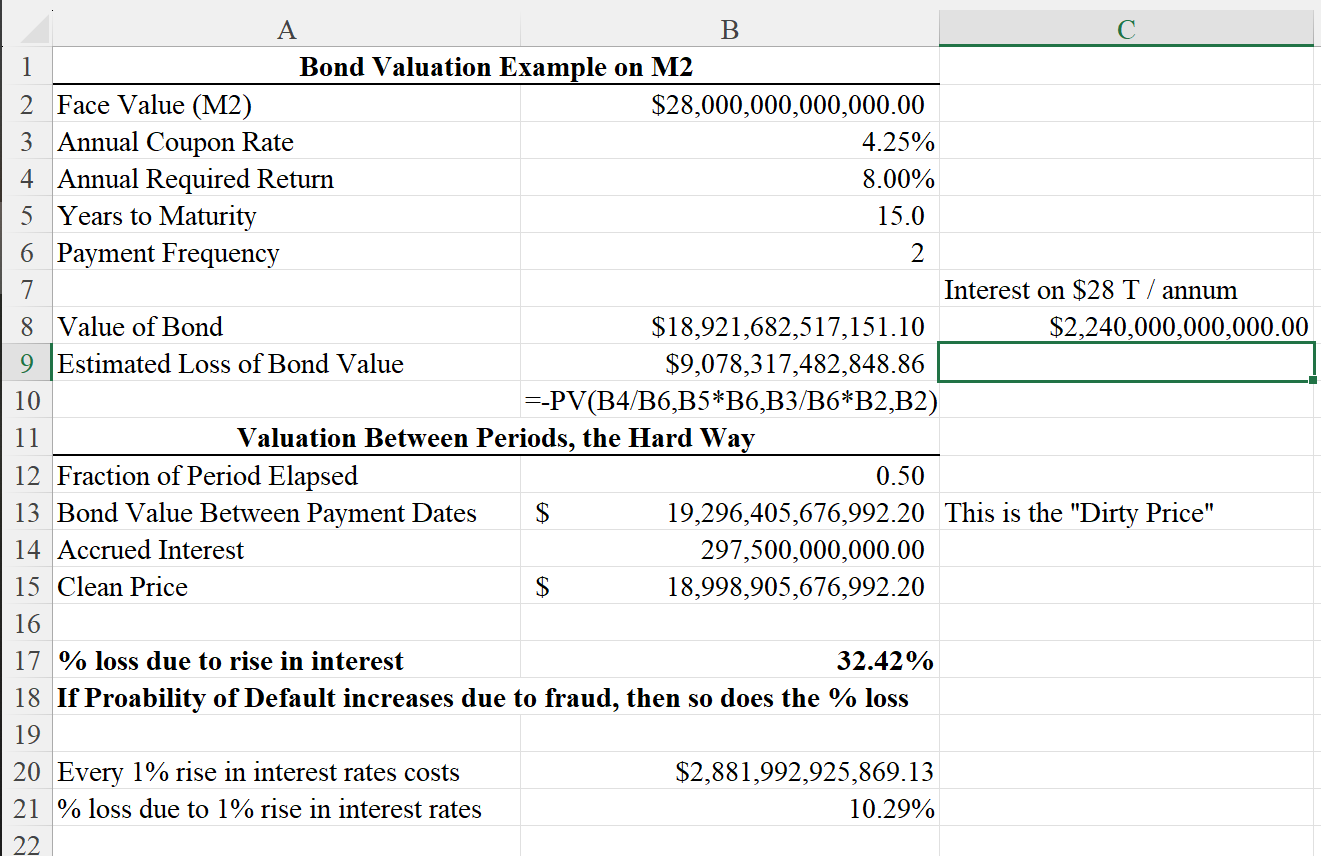

- Denton CAD, the poster child of violated laws, between 2017 and 2023, created $67 Billion in property overvaluation that led to the theft of $1.34 Billion in over taxation, which led to the creation of fraudulent bonds which cannot be paid back in full, where 83% of the local taxable dollars raised by the Taxing Entities go to school districts.

- Gaslighting the public across the U.S. by Chief Appraisers stating property values are going up by 30% which clearly violates all the above laws.

- CADs are censoring property owner evidence and information in ARB hearings.

- Bonds are not being retired, but instead, being rolled up and rolled out.

- Cumulative compounding of the debt, based on Rule of 72, is made worse by not retiring the bonds and paying higher rates of interest when the bonds come due.

- Information is being hidden (omitted) from School District balance sheets: no bond schedules, 313 agreements hidden, political contributions hidden, etc.

The evidence to the above for our case is at www.mockingbirdproperties.com/dcad. You can look at our evidence and modify it to suit your particular circumstance. See Review of Violations pdf document (10 pages).

How many people have had to forgo necessities such as groceries, medicine, home repairs, car payments, rent or mortgage payment because of the CAD’s overvaluation and over taxation resulting from the above violations?

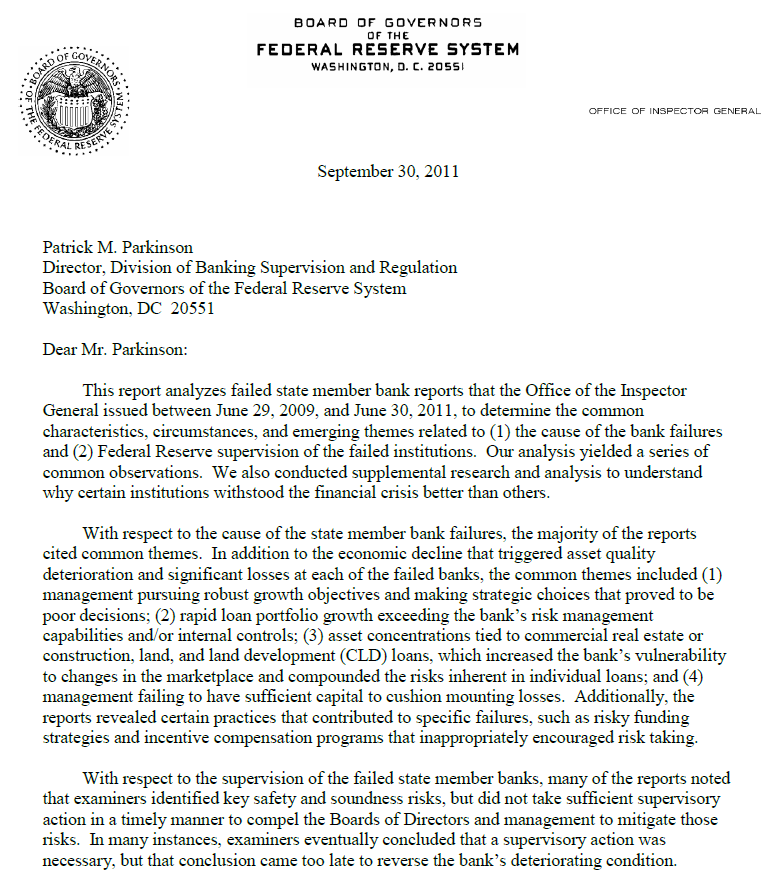

Should those who signed an Oath be held accountable?

Should the Chief Appraiser be jailed for knowingly violating all the above laws? I don’t know what a Judge or Judge(s) will do, but we can certainly point out what laws are being broken.

The role of the government is to protect its citizens from evil doers.

Has the government become the evil doer by failing to protect its citizens and allowing the equity stripping of Mom and Pop to line their pockets, all in violation of existing laws?

Who is monitoring the monitors?

You be the judge!

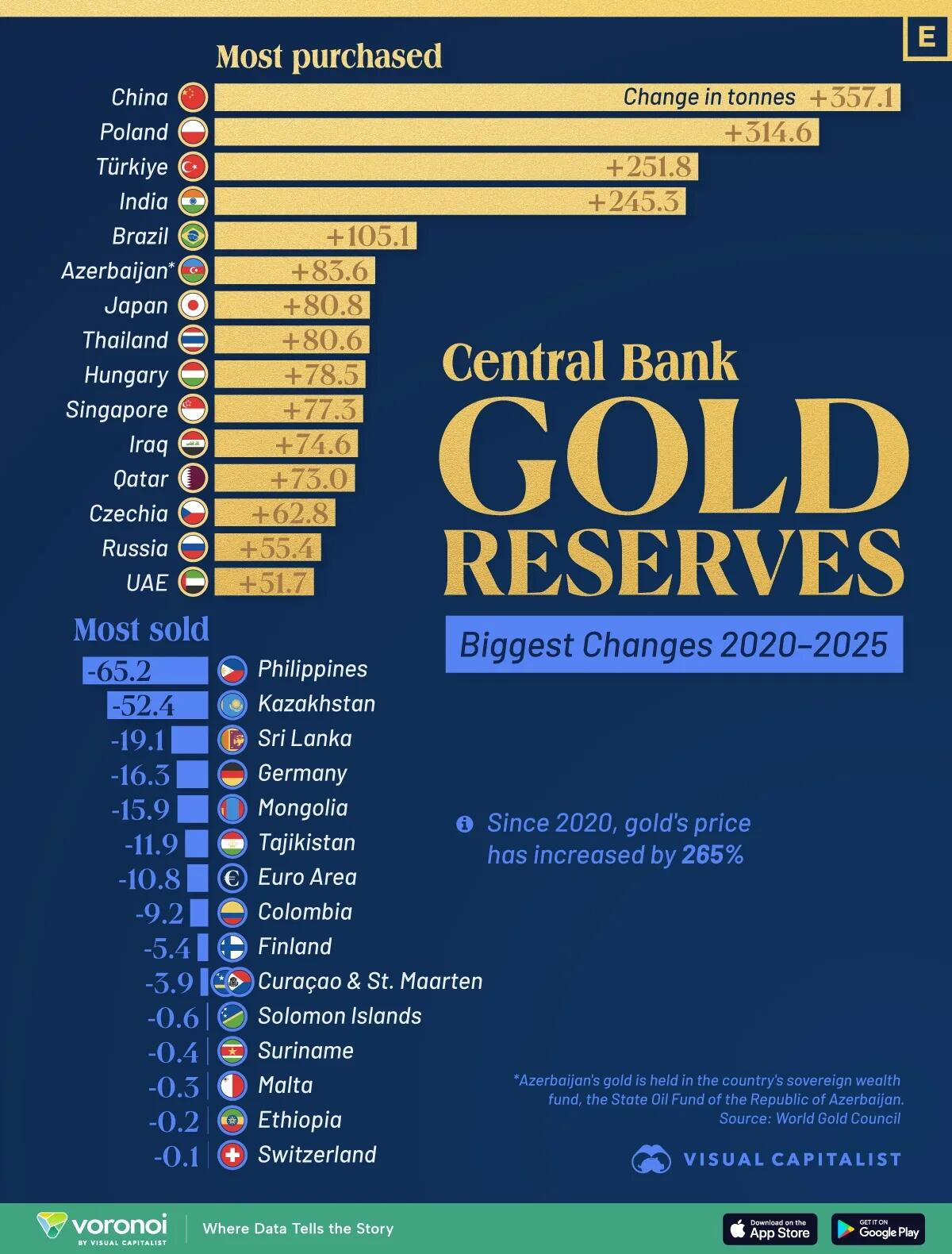

Stability of pricing and government actions are paramount for the success of its Citizens and Businesses!

M.

Mitchell Vexler, President G.P.

Mavex Shops of Flower Mound LP

mitch@mockingbirdprop.com

www.mockingbirdproperties.com