You can believe the Math, or the Politicians, but not both.

By Mitchell Vexler, November 6, 2024

My career was built on thought, as a result of thorough analysis with numbers at the forefront. Although it sounds tough, yet often stated by me, is that I don’t give a damn what someone has to say, but very much I care what can be proven. People / Media talk, yet the majority of the time, have nothing to say which in itself becomes divisive. Knowledge vs Ignorance. Repetition of ignorance is ignorance raised to the power two.

Time and careful thought as seen in documents, writings, videos and presentations, lead to the clarity created by quantifying the issues via math and understanding the associated risk.

People who do stupid things and violate the laws with capital and labor should be accountable, and in the case of intent, jailed. Capitalism works when the playing field is even.

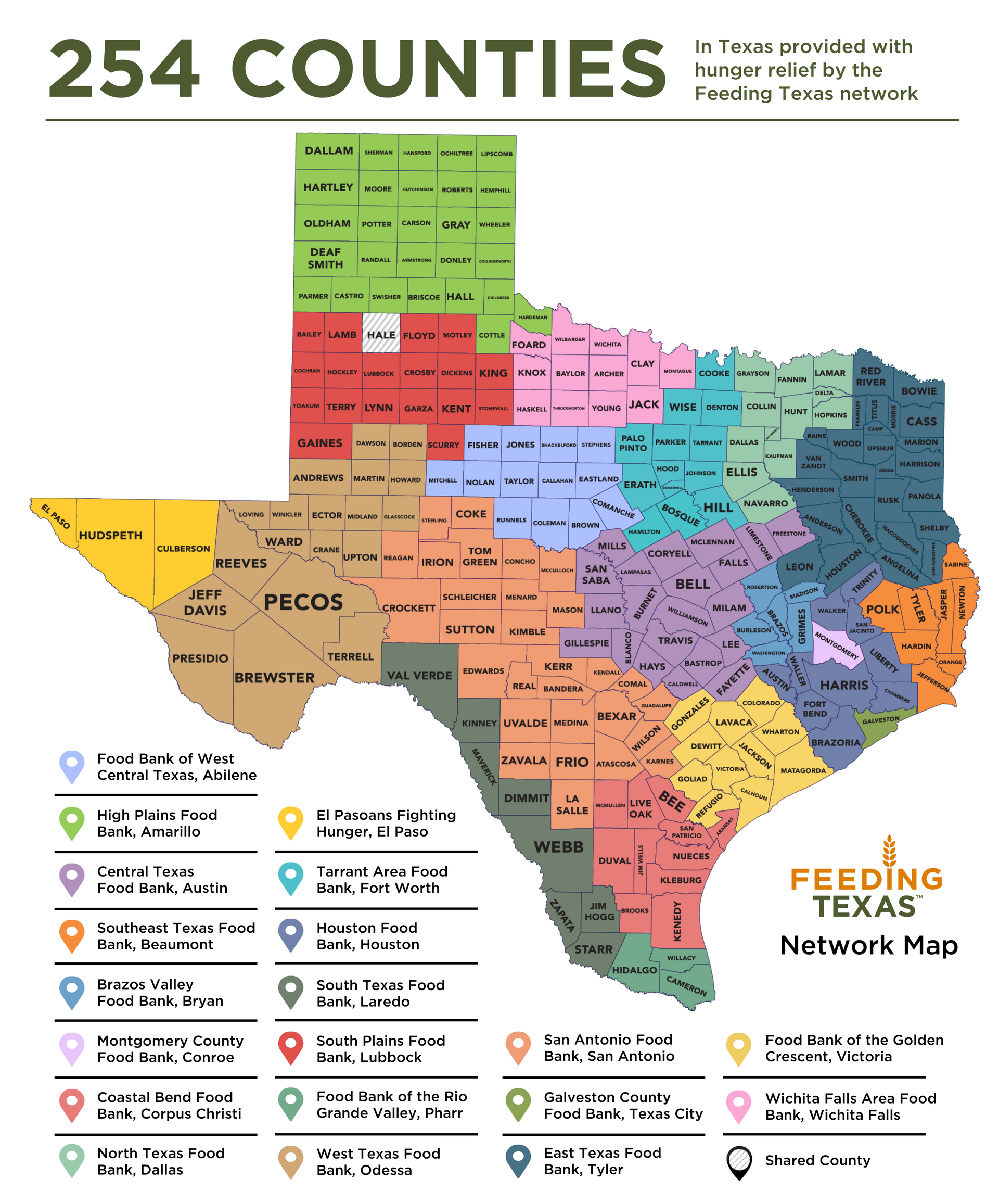

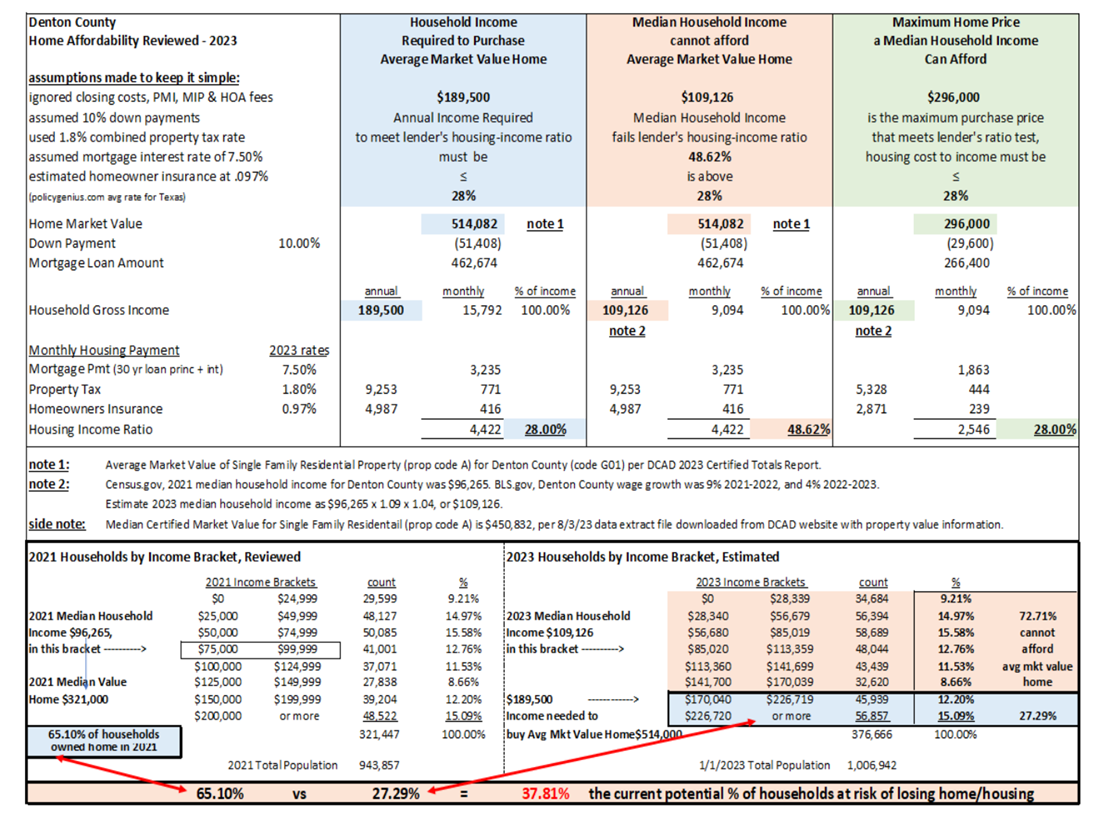

In the series of videos in the Home Value Fraud playlist on Real Estate Mindset YouTube channel, which are built upon each other, and the documents created using government’s own (Local and Federal) numbers, the math is overwhelming as is the risk. The Politicians are watching these videos, and many have received emails and letters from me, yet that didn’t stop the politicians from lying about it, by insisting that everything is fine, or create a scare tactic of “sales tax would have to go to 26%” (based on a dubious and flawed report), and or act with willful intent to ignore State and Federal laws.

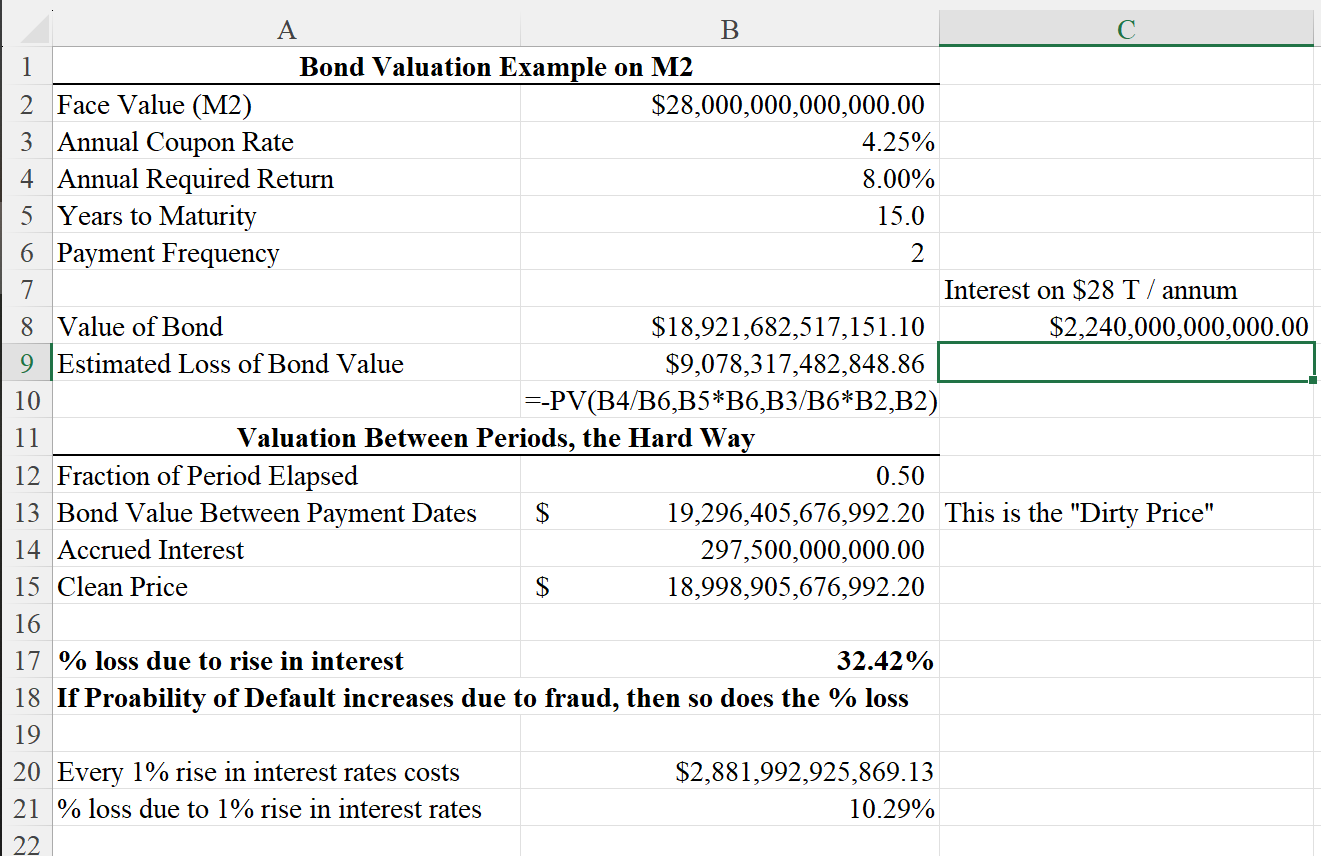

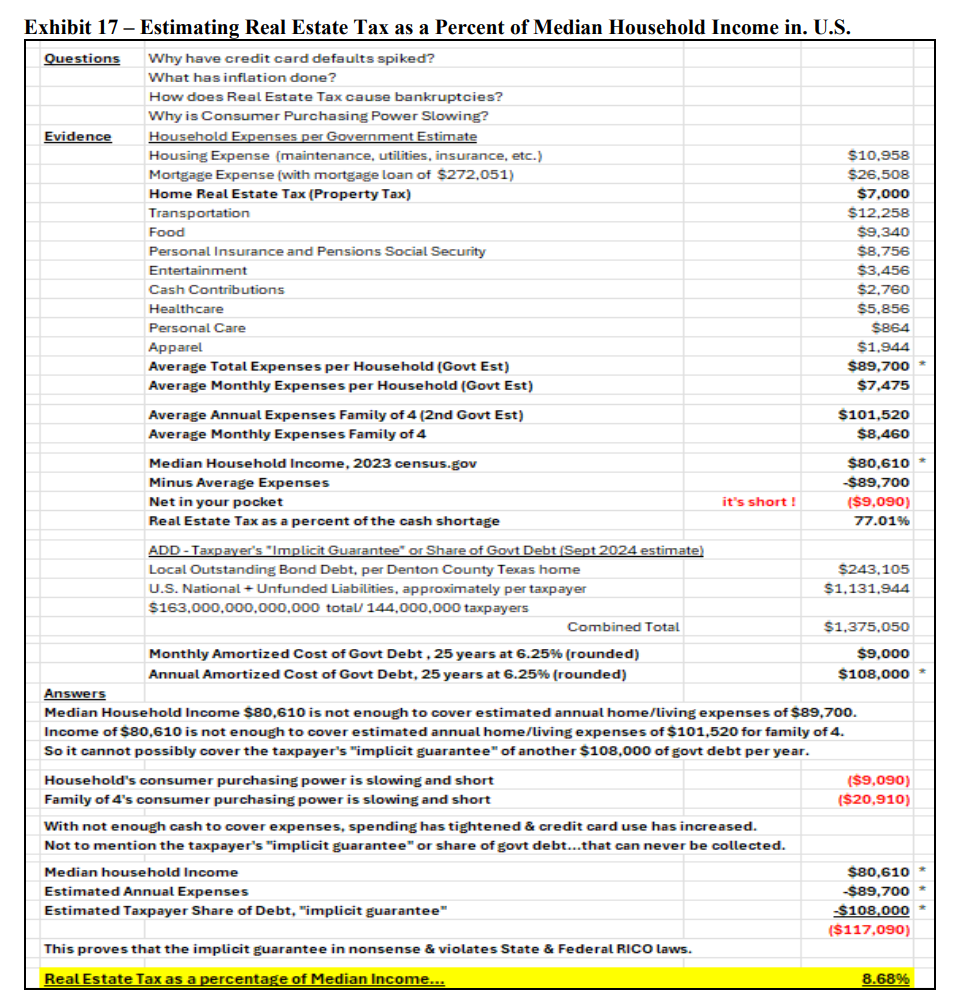

In Texas when a politician is told what the law is, and that is law is being broken, and that politician chooses to ignore the law, that is a violation of both State and Federal laws (“power to prevent”), in Texas that is a 3rd degree felony for impersonating a public official. When school board trustees, who also signed an Oath of office state, say we are “well capitalized” or “there is no problem” or “we are not bankrupt” without producing a shred of evidence, rarely has a bigger lie been told. With a mountain of evidence available, the same can be said for those at the Federal level who refuse to look at the U.S. National Debt + Unfunded Liabilities and explain to the U.S. Taxpayers exactly how those taxpayers (144,000,0000) are each responsible for $1.1M as a result of the Federal system and approximately $240K as a result of the local Taxing Entities, both of which would require an immediate increase in household income by $9,000 per month to pay off over the next 25 years assuming all Federal and Local expenditures are immediately frozen which is impossible because the expenditures continue as does the interest clock by the milli-second. The point being that the debt cannot be paid back as it is impossible for 99.9999% of any taxpayer to increase their immediate revenue by $9,000/month to be amortized over the next 25 years to pay the debt created at the hands of the liars and criminals.

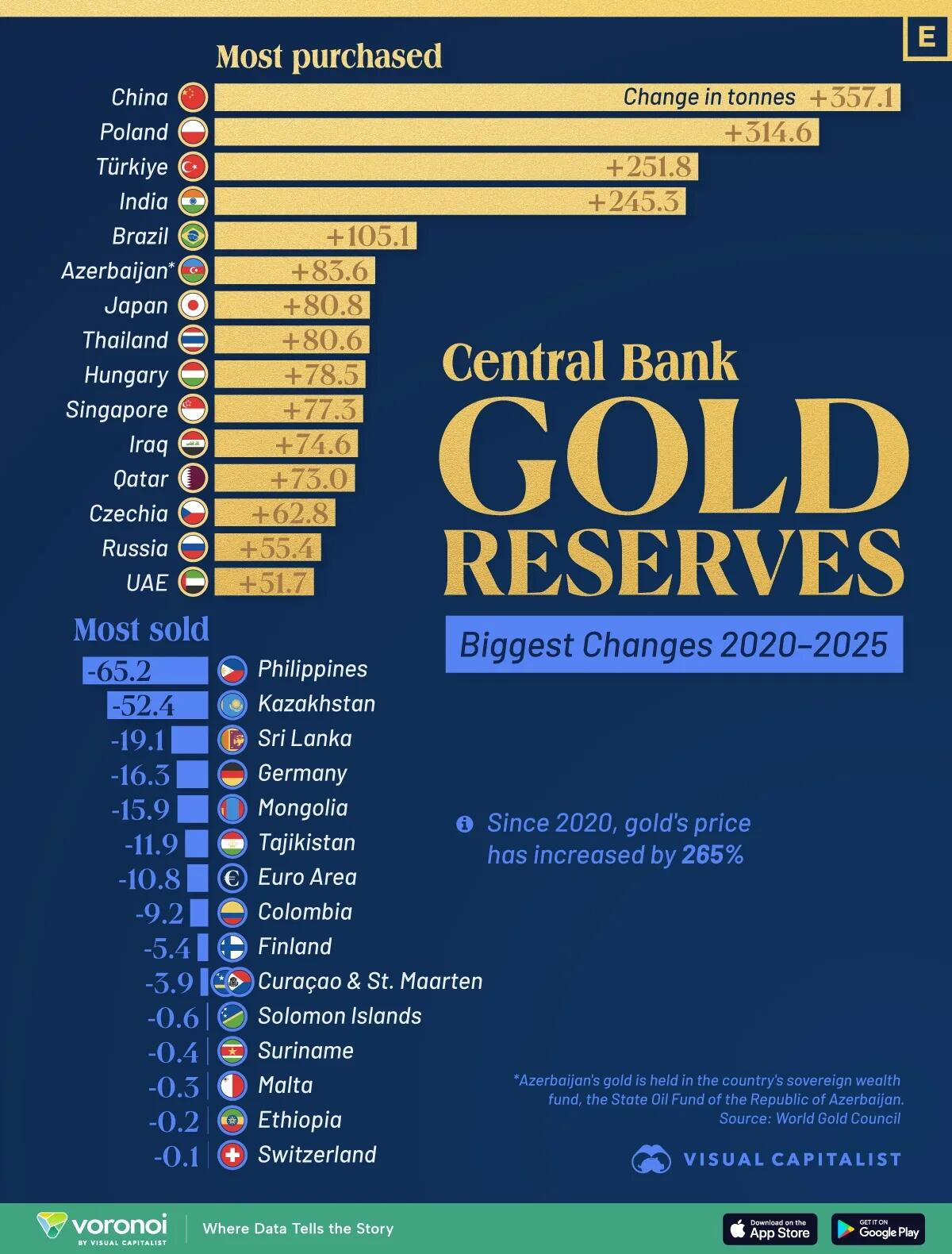

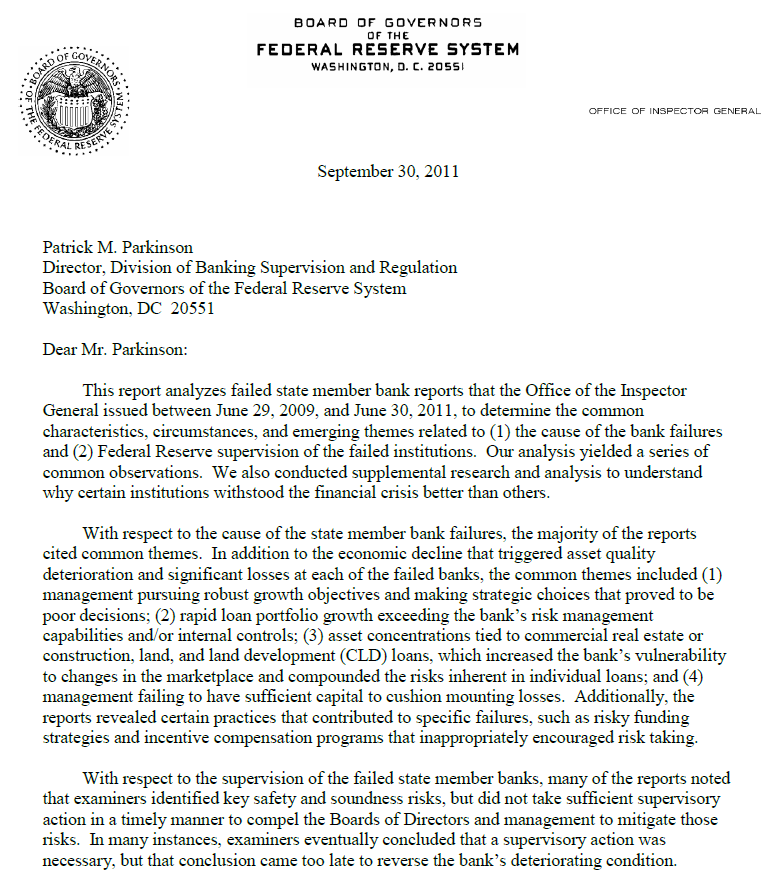

The inter-agency agreements, cross collateralization, on balance sheet and off balance sheet guarantees, mortgage back securities, credit loan obligations, credit default sways, sovereign obligations, and their bailout puppets being the government operated Federal Reserve, International Monetary Fund of the world’s leading “democracies” have financially engineered debts that far exceed our ability to repay, or their ability to manage, and then that garbage has been sold across the globe to be further levered as if it was the physical asset collateral based on the good faith guarantee of that Federal or Local side of the government.

Federal spending is in excess of $5 trillion a year. That is twice what the Federal government collects in income taxes. And it’s equal to the entire federal revenue. After paying for all of these handouts, there’s nothing left – not a penny for interest and not a penny left for paying down debt. In every video on the playlist, https://www.youtube.com/playlist?list=PLo3dZB8Cn9QuemgK3OwUL1qncSqqlfXl , we went into great detail on these items, utilizing spreadsheets, amortization schedules, and Rule of 72 analysis etc. Further, we have also provided access to our evidence at www.mockingbirdproperties.com/dcad.

Americans are becoming more dependent on the Federal government for handouts.

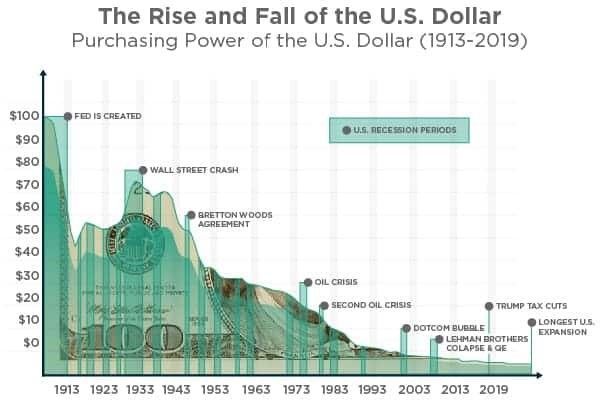

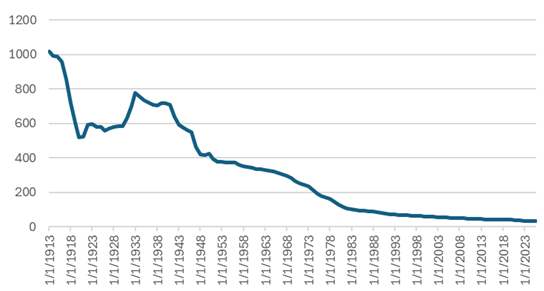

The impact of the demand for handouts can be seen in the amount of money in circulation (M1 money supply). The chart provided by the Federal Reserve shows the impact of printing trillions and trillions of dollars during 2020. The amount of dollars circulating in the banking system grew from $4 trillion to over $20 trillion in a two-year span.

We will continue to see rising inflation and prices as a result.

“Beginning May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and OCDs (before May 2020) or other liquid deposits (beginning May 2020), each seasonally adjusted separately.”

Our interest expense is a function of how much inflation bond investors expect to see in the future. As those expectations rise, so will the government’s funding costs.

This is the loop of doom I referred to in several videos where inflation causes both transfer payments and interest expenses to rise sharply. Efforts to contain the bond market by printing money and buying bonds will make inflation worse and as I stated dozens of times, inflation caused by printing money, is an illegal tax.

Isn’t it interesting that the Local Taxing Entities (regardless of county) have mimicked the Federal level of illicit activity…

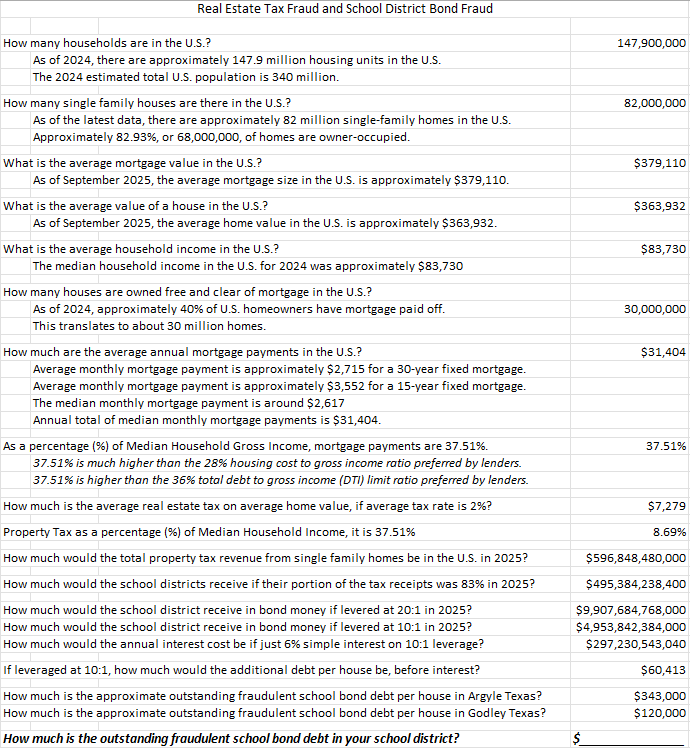

Make fraud impossible to detect, hide the documents (bond schedules, notes to balance sheets, sources and uses), at the School Districts, and then the Central Appraisal Districts, where there is noncompliance with USPAP, State law and U.S. Constitution, have run amok, resulting in approx. $22.5 Trillion of fraud on single family homes in the last 5 years.

Blast public messaging in the local newspapers and at Tax District meetings, that we have to “protect the children”, or my favorite psyops of this election season, “do whatever it takes because democracy Is on the ballot”.

Assure the public that fraud is a myth — which means there’s no need to investigate it — which means that theoretically if a person wanted to do it, they would probably get away with it.

The purpose of the local school bond election is not really to convince the populace that the district has consensus support — only that it has consensus compliance, which clearly, based on the amount owed, it does not and cannot in law.

Thus, those who promote the scam are complicit in aiding and abetting a criminal conspiracy to defraud.

Math provides and demands transparency.

For those who choose to turn a blind eye and let the criminals be criminals by hiding the evidence (math), you will likely get what you deserve. Apathy is what will lead to bad results. You must get involved and protest your property values, force the school districts to deliver the bond schedule, file suit against those who refuse to adhere to the law, and demand prosecution.by your district attorney. We know the problem and have articulated the answer.

Either way, inflation is likely going much higher. But when we speak in unison and make demand for instant transparency (audits and criminal charges) our numbers and strength is much greater than any politician can withstand.

You can believe the numbers. Or you can believe the politicians, print media, and liars on TV, but you can’t do both.

Other recent documents to examine:

Wheel of Fraud at the Local Taxing Entities / Central Appraisal Districts Level

Benefits of Eliminating Real Estate Tax in Favor of Uniform State(s) Sales Tax

M.