FED Analysis: CPI, the Ultimate Big Lie

Average Household Incomes are short $9,000 / yr.

By Mitchell Vexler, January 9, 2025

In the summation on the analysis on over 100 pages of information and articles on the Federal Reserve (link), combined with the current state of the U.S. economy and its citizens financial well-being, I have compiled a list of over 50 reasons why the Federal Reserve should be shut down.

1. We like to think that we have a government “of the people, by the people, for the people”, but the reality is that an unelected, unaccountable group of central planners has power over the national and global economy than the world recognizes all at the expense of Mom and Pop.

Isn’t it interesting that…

A. The Fed creates inflation by allowing the printing of money to cover for the nonstop spending of the Federal Government which created $36 Trillion in U.S. National Debt as of the end of 2024, plus the deficit. The compound cumulative interest on the debt will continue to grow because the debt is not being paid off and cannot be paid off as the GDP would literally have to double in 2025 to $51 Trillion in order to pay down just $2 Trillion of the Debt in 2025 and this assumes that the government spending stopped on December 31, 2024. In fact, the rule of 72, plus the velocity of government spending means that there is a high probability that in 5 to 7 years the existing debt will double again. What are they going to do…print more money and turn the U.S. into the Weimer Republic and take down the rest of the global economies at the same time???

B. Now the flavor of the week is the Fed claiming Quantitative tightening for the purpose of getting the banks to lend less to slow inflation down. Banks’ lending less to meet the artificially contrived balance sheet requirements of the FED is the exact opposite of what should be done to grow the economy. Neither The Fed nor the banks can tell good loan risk from a bad loan risk as they both are “portfolio loans”. They paint the narrative with the broad brush of ignorance instead of truly understanding that destroying the economic engine of Mom and Pop is horribly counterproductive both on a National and Global scale. Therefore, mandating the banks raise liquidity and slow lending may result in a crash of the market. Slowing lending is not the fix to inflation as the pendulum may swing too far and destroy the economy simultaneously. The government spending and devaluation of purchasing power are the problems. Banks being allowed to sell the loans they make is a problem. Banks being undercapitalized is a problem. However, these bank problems combined pales in comparison to the government spending and creation of trillions in debt and unfunded liabilities which cannot be paid back by Mom and Pop. This is paper chasing paper not backed by underlying hard assets.

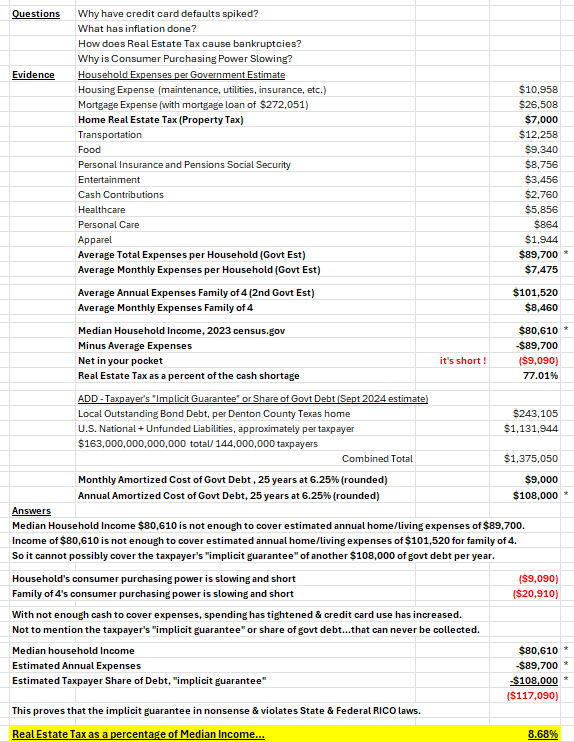

C. At the local Taxing Entity level, the real estate tax fraud, in the last 5 years, has created $21.25 trillion in property overvaluation across the U.S. from which to steal $450 billion from Mom and Pop in 2024.

D. This schizophrenic yo-yo behavior by the Federal Reserve, is for benefit of the banks, the existence of the Federal Reserve itself, and not for the benefit of the public as it is Mom and Pop that ends up footing the bill through inflation + U.S. National Debt + Unfunded Liabilities + devaluation of purchasing power, all of which is equity stripping not to mention the roughly $250K owed per household as created by the local Taxing Entities via their owned Central Appraisal Districts. The left hand (FED) doesn’t know what the right hand (Local Taxing Entities) is doing and that is exactly why the 16th Amendment to the U.S. Constitution prohibits taxation on unrealized gains. Market Value is a tax on an Unrealized Gain.

“I sincerely believe…that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale.” Thomas Jefferson 1816

2. The Federal Reserve is “independent” of the government. NO, it is not! Although the Federal Reserve has argued vehemently in federal court that it is “not an agency” of the federal government and therefore not subject to the Freedom of Information Act, in fact, the Federal Reserve would not exist but for Congress granting its existence. This mirrors the exact same nonsense where the State of Texas created the Taxing Entities which own the Central Appraisal Districts (which commit fraud) and then the State (State Comptroller, TDLR, TALCB) claim they have no authority to enforce. Therefore, in both cases the government (State and Federal) are the purveyors of fraud on a mass scale. If no one has the authority to enforce the law, then there is no law as law must exist to protect both parties of the contract. This is the exact point we are making in the current lawsuit now at the Fort Worth Court of Appeals.

3. The Federal Reserve openly admits that the 12 regional Federal Reserve banks are organized “much like private corporations “. Obviously, I did not perform an audit on the FED, but somebody with authority and a proper scope of work with a background in forensic accounting should. Who knows…this article might act as a decent check list of what to look for.

4. The regional Federal Reserve banks issue shares of stock to the “member banks” that own them. This is a huge warning flag.

5. 100% of the shareholders of the Federal Reserve are private banks. The U.S. government owns zero shares.

6. The Federal Reserve is not an agency (so they claim – see #2 above) of the federal government, but it has been given power to regulate banks and financial institutions. Under no circumstance should this happen because it circumvents normal market conditions, the result of which is inflation at both the Federal and Local Taxing Entity levels. See https://www.youtube.com/watch?v=OdE6L8n3gvw, a video by Mitchell Vexler and Travis Spencer released 12/27/24 discussing the correlation between the Federal Reserve and the local Taxing Entities which control the Central Appraisal Districts.

7. According to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to “coin Money, regulate the Value thereof, and fix the Standard of Weights and Measures”. Why is the Federal Reserve doing it? On a side note, the Unit is the BRICS (Brazil, Russia, India, China, South Africa) attempt to de-lever from the U.S. dollar / Treasuries from which the formula is 40% gold *by weight) and 60% based on a basket of BRICS currencies. That is “Standard of Weights and Measures” by definition and can only happen under the authority of Congress not the FED.

8. If you look at a “U.S. dollar”, it actually says “Federal Reserve note” at the top. In the financial world, a “note” is an instrument of debt.

9. In 1963, President John F. Kennedy issued Executive Order 11110 which authorized the U.S. Treasury to issue “United States notes” which were created by the U.S. government directly and not by the Federal Reserve. He was assassinated shortly thereafter. It is clear that the most basic lack of understanding of the ramifications of these actions was unknown by those who simply went along with the unyielding spending of the Federal Government and the cumulative compounding of both the debt and the interest thereon.

10. The Federal Reserve determines at what levels some of the most important interest rates in our system are going to be set. In a free market system, the free market would determine those interest rates. What we now have morphed into is a 50-50 bet on what the FED will determine to be interest rate up or down this quarter. As a 50-50 bet there is no edge and if there is no edge then why does the FED exist??

11. The Federal Reserve has become so powerful that it is known as “the fourth branch of government”. The Federal Reserve has exported its nonsense to other countries in the form of the IMF (International Monetary Fund) which is the mirror of the FED. The IMF has destroyed the economies of many European countries via the European Union in which its creation ended up reducing the assets of the Citizens and then saw the correlated growth of the IMF. Same can be said for the Bank of Canada which is the central bank of Canada.

12. The greatest period of economic growth in U.S. history was when there was no central bank.

13. The Federal Reserve was designed as a back stop to the banks. The bankers that designed it intended to trap the U.S. government in a perpetual debt spiral from which it could never possibly escape but for complete destruction of the U.S. economy. Since the Federal Reserve was established 100 years ago, the U.S. national debt is now more than 5000 times larger.

14. A permanent federal income tax was established the exact same year that the Federal Reserve was created. This was not a coincidence. In order to pay for all of the government debt that the Federal Reserve would create, a federal income tax was necessary. The whole idea was to transfer wealth from the pockets of Mom and Pop to the federal government and from the federal government to the banks to fuel more excessive growth i.e. taking highly levered risks with other people’s money.

15. The period prior to 1913 (when there was no income tax) was the greatest period of economic growth in U.S. history.

16. Today, the U.S. tax code is 2,652 pages long and Title 26 is 6,550 pages long so trying to wrestle such a document is difficult to say the least.

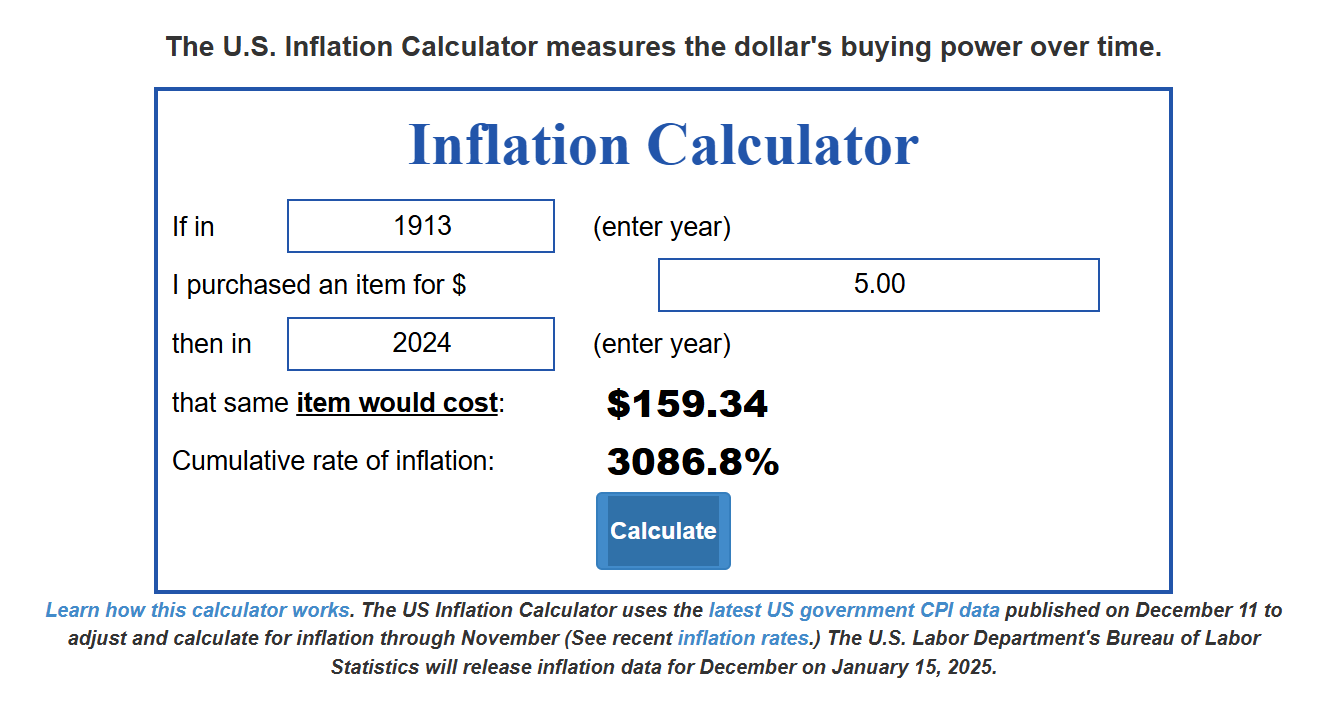

17. From the time that the Federal Reserve was created until now, the U.S. dollar has lost over 97 percent of its purchasing power.

18. From the time that President Nixon took us off the gold standard until now, the U.S. dollar lost 83 percent of its value.

19. During the 100 years before the Federal Reserve was created, the U.S. economy rarely had any problems with inflation. But since the Federal Reserve was established, the U.S. economy has experienced constant and never-ending inflation which has the effect of creating more economic cycle crises following crises instead of smoothing out the gyrations. In other words, it is the existence of the FED which is creating the gyrations / sine waves / crises via the manipulation of the markets to allow paper to chase paper.

20. In the century before the Federal Reserve was created, the average annual rate of inflation was about half a percent which is reasonable for normal supply and demand markets. In the century since the Federal Reserve was created, the average annual rate of true inflation has been about 3.5 percent.

21. The Federal Reserve has stripped the middle class of trillions of dollars of wealth through the hidden tax of inflation.

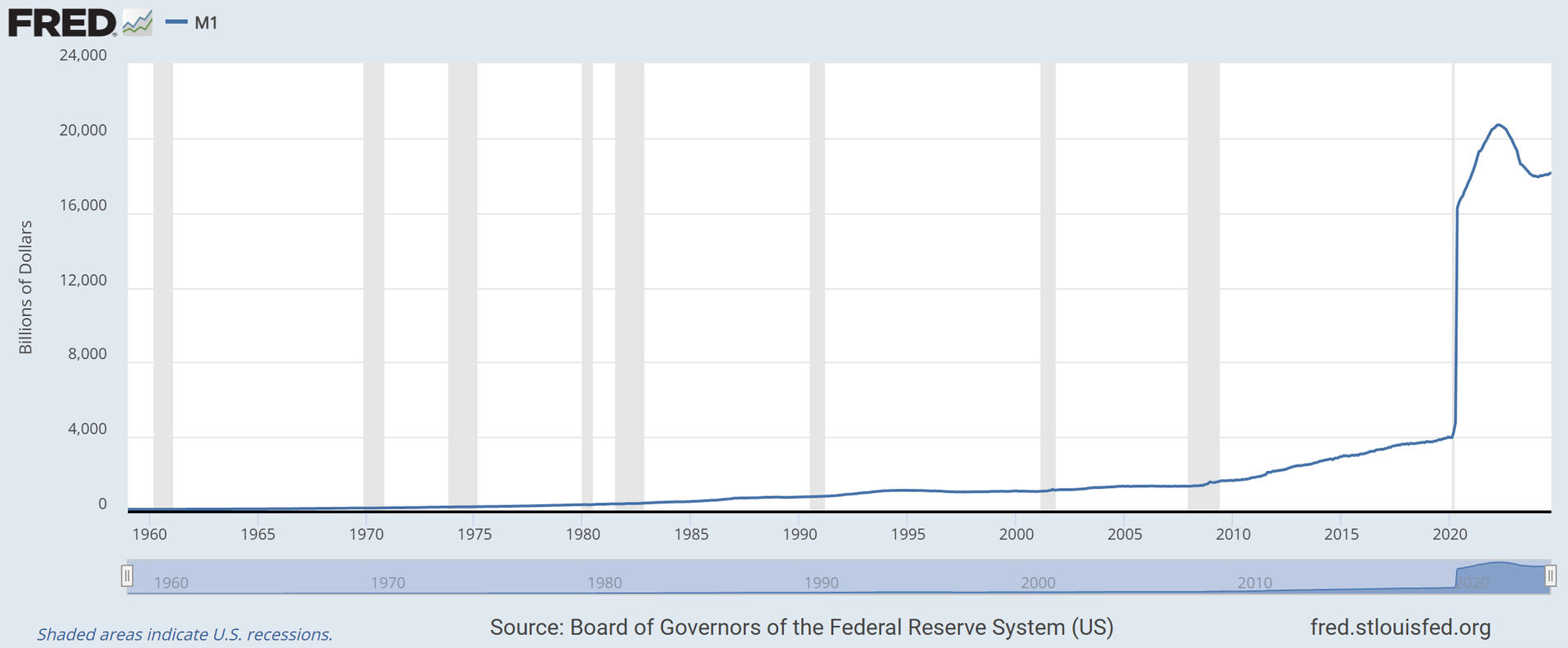

22. The size of M1 has nearly doubled since 2008 thanks to the reckless money printing that the Federal Reserve has been doing.

23. Weimar Republic failed as a result of printing money to the point where it took a wheelbarrow of notes to buy a loaf of bread, and we all remember how that ended. See video discussion by Mitchell Vexler, What is Inflation – Truth vs Omission, Omission by Intent = Intent to Defraud, at https://www.youtube.com/watch?v=Y0XsvlT3jp4&list=PLo3dZB8Cn9QuemgK3OwUL1qncSqqlfXl_&index=3.

24. The Federal Reserve has been consistently lying to us about the level of inflation in our economy. If the inflation rate was still calculated the same way that it was back when Jimmy Carter was president, the official rate of inflation would be somewhere around 10 percent today.

25. Since the Federal Reserve was created, there have been 21 distinct recessions or depressions: 1918, 1920, 1923, 1926, 1929, 1937, 1945, 1949, 1953, 1958, 1960, 1969, 1973, 1980, 1981, 1990, 2001, 2008, 2014, 2020 (covid).

26. Within 20 years of the creation of the Federal Reserve, the U.S. economy plunged into the Great Depression.

27. The Federal Reserve created the conditions that caused the stock market crash of 1929, and even Ben Bernanke admits that the response by the Fed to that crisis made the Great Depression even worse than it should have been.

28. The “easy money” policies of former Fed Chairman Alan Greenspan set the stage for the great financial crisis of 2008.

29. Without the Federal Reserve, the “subprime mortgage meltdown” would not have happened. There would not be paper chasing paper.

30. There have been 10 different economic recessions since 1950. The Federal Reserve allowed “dotcom bubble”, the Federal Reserve created the “housing bubble” and now it has allowed “the everything bubble” which threatens to plunge the Nation and Global economies into the worst economic downturn in world history once it bursts. When was the last time, you saw a Federal Reserve Chairman yell at Congress to stop the spending which creates the inflation which can’t be paid back?? We are at the tipping point! Mom and Pop don’t have the money. Subprime auto loans defaulting, credit card default rates expanding by 50%, housing inventories climbing, land sales slowing, consumer purchasing slowing, real estate taxes magically increasing, etc.

31. According to an official government report (GAO), the Federal Reserve made 16.1 trillion dollars in secret loans to the big banks during the last financial crisis. The following is a list of loan recipients that was taken directly from page 131 of the report… For full report see https://www.gao.gov/assets/gao-11-696.pdf

Citigroup – $2.513 trillion

Morgan Stanley – $2.041 trillion

Merrill Lynch – $1.949 trillion

Bank of America – $1.344 trillion

Barclays PLC – $868 billion

Bear Sterns – $853 billion

Goldman Sachs – $814 billion

Royal Bank of Scotland – $541 billion

JP Morgan Chase – $391 billion

Deutsche Bank – $354 billion

UBS – $287 billion

Credit Suisse – $262 billion

Lehman Brothers – $183 billion

Bank of Scotland – $181 billion

BNP Paribas – $175 billion

Wells Fargo – $159 billion

Dexia – $159 billion

Wachovia – $142 billion

Dresdner Bank – $135 billion

Societe Generale – $124 billion

“All Other Borrowers” – $2.639 trillion

This proves beyond any doubt that the FED exists to backstop the banks at the expense of Mom and Pop.

32. The Federal Reserve also paid those big banks $659.4 million in “fees” to help “administer” those secret loans.

33. During the last financial crisis, big European banks were allowed to borrow an “unlimited” amount of money from the Federal Reserve at ultra-low interest rates. This proves the global nature of the scheme and if the U.S. gets sick the economic connected nature with the Fed in the middle ensures they will get pneumonia.

34. The “easy money” policies of Federal Reserve Chairs Ben Bernanke, Janet Yellen, and Jerome Powell have created the largest financial bubble this nation has ever seen, and this has set the stage for the great financial crisis that we are now in, and it will get worse. I have shown that roughly $1.38 million comprised of U.S. National Debt, Unfunded Liabilities and local Taxing Entity debt (roughly $250,000) exists on every single home in the U.S. which would require roughly $9,000 per month to pay this off over the next 25 years at 6.25%. Meaning it is impossible for this debt, created by the Government, and its corresponding compound cumulative inflation and further enhanced by the Central Appraisal Districts to be paid off.

35. Since late 2008, the size of the Federal Reserve balance sheet has grown from less than one trillion dollars to more than seven trillion dollars ($7,000,000,000,000.00) just depending on what crises the FED has induced. This is complete and utter insanity.

As I have said in multiple videos and in writing: high Inflation is the sign of a declining currency and loss of purchasing power.

Money is credit, government debt is fiat currency, currency depreciation is inflation (tax), and inflation is an implicit default (exact opposite of implicit guarantee) = Equity Stripping = Socialism + Government Control = why voting matters and why math matters. At the local Taxing Entity level, your implicit guarantee = the guarantee of an implicit default (created by the Taxing Entities and the Federal Reserve). At the Federal level, your implicit guarantee = the guarantee of an implicit default created by the Federal Government which authorized the existence of the Federal Reserve, and so far, has failed to shut it down.

A = B and B= C then A = C

Your implicit guarantee = an implicit default.

I created the term “implicit guarantee” to help explain the results of the Federal Reserve and Local Taxing Entities. No person that I know of has ever agreed to become a slave to someone else’s debt!

The following graphics show the devaluation of purchasing power.

See video, What is Inflation – Truth vs Omission. Omission by Intent = Intent to Defraud,

https://www.youtube.com/watch?v=Y0XsvlT3jp4.

36. The narrative that the economy is strong is a false narrative. The only thing that matters is the median household income. If 32% of the households can’t afford the roof over their head, then that is the irrefutable proof of the false narrative. The average homeowner (Mom and Pop) with an income of $80,000 is roughly $9,000 short per year which explains the 50% increase in the default rate on credit cards.

If you believe that 32% of households don’t matter, then consider if they don’t pay their debt, those debts then become transferred to the remaining households, thus a closed loop argument and system failure. These debts cannot be pushed onto the remaining household.

37. Quantitative easing creates financial bubbles, and when quantitative easing ends those bubbles tend to deflate rapidly.

38. Most of the new money created by quantitative easing has ended up in the hands of the very wealthy, which is obvious because they have their money at play in the markets both stock and debt. What is not obvious is that the taxpayers end up paying for interest on the debts and further take the principal loss when the debt value crashes (pensions and 401Ks) and those pension holders are the taxpayers meaning Mom and Pop.

39. Another way to look at this setup is that quantitative easing is a giant “subsidy” for national and international banks all on the backs of Mom and Pop. Quantitative tightening, that is allegedly designed to slow the bank lending down, raises the cost of funds for businesses which raises prices. So, the ping pong narrative proves it works against Mom and Pop in both directions because the market is manipulated in favor of the banks.

40. Why do stocks, bonds, art and Ferraris balloon in value? It is because at that moment, they are hard assets as compared to devaluing cash / currency.

41. The mainstream media has sold quantitative easing to the American public as an “economic stimulus program”. NO, it is not. It is for the banks and the illusion of economic stimulus (“full employment” and “low inflation”) is a lie.

42. For years, the projections of economic growth by the Federal Reserve have consistently overstated the strength of the U.S. economy. But every single time, the mainstream media continues to report that these numbers are “reliable”. These consistent lies, even out of ignorance, make the mainstream media culpable in deluding the public, even if it is considered wishful thinking it ends up being pure fraud perpetrated on a global scale.

43. The Federal Reserve system fuels the growth of government, and the growth of government fuels the growth of the Federal Reserve system. Federal spending, plus the cumulative compounding of debt and interest has grown exponentially over the median household income. Again, it is impossible for Mom and Pop to pay off these debts. Government for the sake of government at the expense of its Citizens is the definition of tyranny.

44. The six largest banks in the United States are JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley now account for roughly 42 percent of all loans in the United States.

45. We were told that the purpose of quantitative easing was to help “stimulate the economy”, but the Federal Reserve was actually paying the big banks not to lend out 1.8 trillion dollars in “excess reserves” that they have parked at the Fed and the payments are in the overnight repo market.

46. The Federal Reserve has allowed an absolutely gigantic derivatives bubble to inflate which could destroy our financial system at any moment. As of 2024, four of the “too big to fail” banks (JP Morgan, Citibank, Goldman Sachs) each have total exposure to derivatives that is well in excess of 203 trillion dollars depending on which report you are looking at, none of which seems to be complete.

47. The Federal Reserve system and the Central Appraisal Districts (owned by the local Taxing Entities) are the biggest Ponzi scheme in the history of the world, and both are the purveyors of fraud and inflation.

48. The following comes directly from the Fed’s official mission statement: “To provide the nation with a safer, more flexible, and more stable monetary and financial system.” Without a doubt, the Federal Reserve has failed.

49. The Fed decides what the target rate of inflation should be, what the target rate of unemployment should be and what the size of the money supply is going to be. This is quite similar to the “central planning” that goes on in communist nations and clearly that central planning has failed and has never worked.

50. Thanks to this endless debt spiral that we are trapped in, a massive amount of money is transferred out of our pockets and into the pockets of the ultra-wealthy each year. This year, the federal government will spend more than one trillion dollars just on interest on the national debt and create a deficit of $1.8 Trillion in 2024.

51. The American people are being killed by cumulative compound interest but most of them don’t even understand what it is. Albert Einstein once made the following statement about compound interest…

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

The term cumulative compounding is another term that I came up with to help describe the equity stripping of Mom and Pop because it is the opposite of an amortization schedule which is paid off over time. If the debts of the government (Local and Federal) are rolled out and interest rates rolled up, that is the cumulative compounding effect which in fact is fraud by omission created at both levels of the government. The intent to defraud is laid bare when no school district that we have seen yet, has produced a bond schedule, balance sheet with proper notes, and a sources and uses. The intent to defraud is the existence of the Federal Reserve. As an important sidenote, which one of the banks who sold the school bonds (to the Pensions, 401Ks, Mom and Pop), did the due diligence on the source of the revenue paid to the Taxing Entities / School Districts, to determine that the underlying tax receipts were created by fraud (over valuation resulting in over taxation)??? Who is the bond underwriter??? Who are the attorneys responsible for aiding and abetting a criminal conspiracy to defraud???

52. What does the Federal Reserve do with those U.S. Treasury bonds? They end up getting auctioned off to the highest bidder. But this entire process actually creates more debt than it does money. The U.S. Treasury bonds that the Federal Reserve receives in exchange for the money it has created out of nothing are auctioned off through the Federal Reserve system. Admittedly, willing buyer and willing seller. However, price is what is paid, and value is what is received. I suspect that those doing the buying are using someone else’s money to keep the illusion going based on the “good faith and credit of the U.S. Government”.

With the above said, there is a circular problem.

Because the U.S. government must pay interest on the Treasury bonds, the amount of debt that has been created by this transaction is greater than the amount of money that has been created.

So where will the U.S. government get the money to pay that debt?

Well, the theory is that we can get money to circulate through the economy really fast and tax it at a high enough rate the government will be able to collect enough taxes to pay the debt.

But that never happens, because as I have pointed out multiple times, the only denominator that actually matters is the median household income. Nothing else!

We are at the tipping point. This is not sustainable. Where will the money come from to cover the U.S. National Debt + Unfunded Liabilities + Local Debt which amounts to roughly $1,380,000 per household at an amortized cost of roughly $9,000 per month at 6.25% for the next 25 years above the current household income?

THE ULTIMATE BIG LIE… CPI = CP LIE

Asset values rise and fall but debt obligations are fixed.

Debt to GDP is important to understand and realize that it can’t be paid off.

When Lehman Brothers collapsed the debt to GDP was 40% in 2008. Today it is roughly 120%, that is a 300% increase.

The U.S. fiscal ability to deal with a financial crisis has declined to the point of the eventual loss in confidence in the U.S. Dollar.

To understand what this means, let’s break it down to a person with a gross income of $100,000 and a debt load of $40,000. After all of your other expenses you can likely service the debt with no issue because the leverage is capped.

Now 20 years later let’s say your gross income is the same $100,000 but your debt load is $120,000.

The probability of paying off this debt is near zero in the next 30 years even with reasonably interest.

The government / FED is inflating away the net present value of its obligation, meaning they will pay it off with cheaper dollars from the devaluation of your purchasing power.

Between 1970 and 1980 the purchasing power of the U.S. dollar declined by 75%.

If you believe that Social Security, Military Pensions, Medicare, Medicaid, Teacher Pensions will be honored, then you must realize that the purchasing power of those dollars paid in the future will decrease meaning the current dollar buys less goods, yet the obligation on paper is being bought down with cheaper dollars via inflation. The purchasing power of those dollars you will receive in the next 10 years has a high probability of being reduced by 75%. Let’s say in 10 years you may receive $4,000 in Social Security which sounds ok today, until you realize that the purchasing power of that payment will likely be just $1,000, which by then may be the equivalent of 2 grocery carts of food.

The FED changed the definition of CPI now to exclude food (groceries), fuel, health insurance, tax, and increased costs of goods and services which are arbitrarily assigned a value. Has your cost of living only increased by 2.6% per year over the last 5 years as stated by the FED? Has your cost of health insurance only gone up 2.6% per year? Have your groceries only gone up 2.6% per year? How about your rent? The purchasing power of the U.S Dollar has declined by at least 7.5% compounded per year over the last 5 years.

See: #35 above. Inflation is the devaluation of your purchasing power, and the CPI is the Ultimate Big Lie.

If you are planning for retirement and your thought process is based on an adequate life today and your project forward 10 years using realistic inflation assumptions, your income may not be sufficient to maintain your retirement living standards.

The purchasing power of the cash you have in the bank is probably diminishing by 7.5% per year compounded.

If you rely on the government for subsidies, you are putting yourself in harm’s way. The opposite of this statement is that you must rely on yourself, not the government. Burying your head in the sand is counter-productive and all that is evidenced in this document is exactly why each property owner must take an active role in eliminating the real estate taxes in favor of a Uniform States Sales Tax, and why each taxpayer must take an active role in their future given the devaluation of currency.

“Those who have the privilege to know have the duty to help”. Einstein

“They who can give up essential Liberty to obtain a little temporary Safety, deserve neither Liberty nor Safety”. Benjamin Franklin

Resources:

https://www.zerohedge.com/economics/why-property-tax-illegal

https://www.youtube.com/playlist?list=PLo3dZB8Cn9QuemgK3OwUL1qncSqqlfXl_

and www.mockingbirdprop.com/dcad for links to videos, evidence, petition, interviews, articles.

M.