Flaw of the Institutional Perception

by Mitchell Vexler

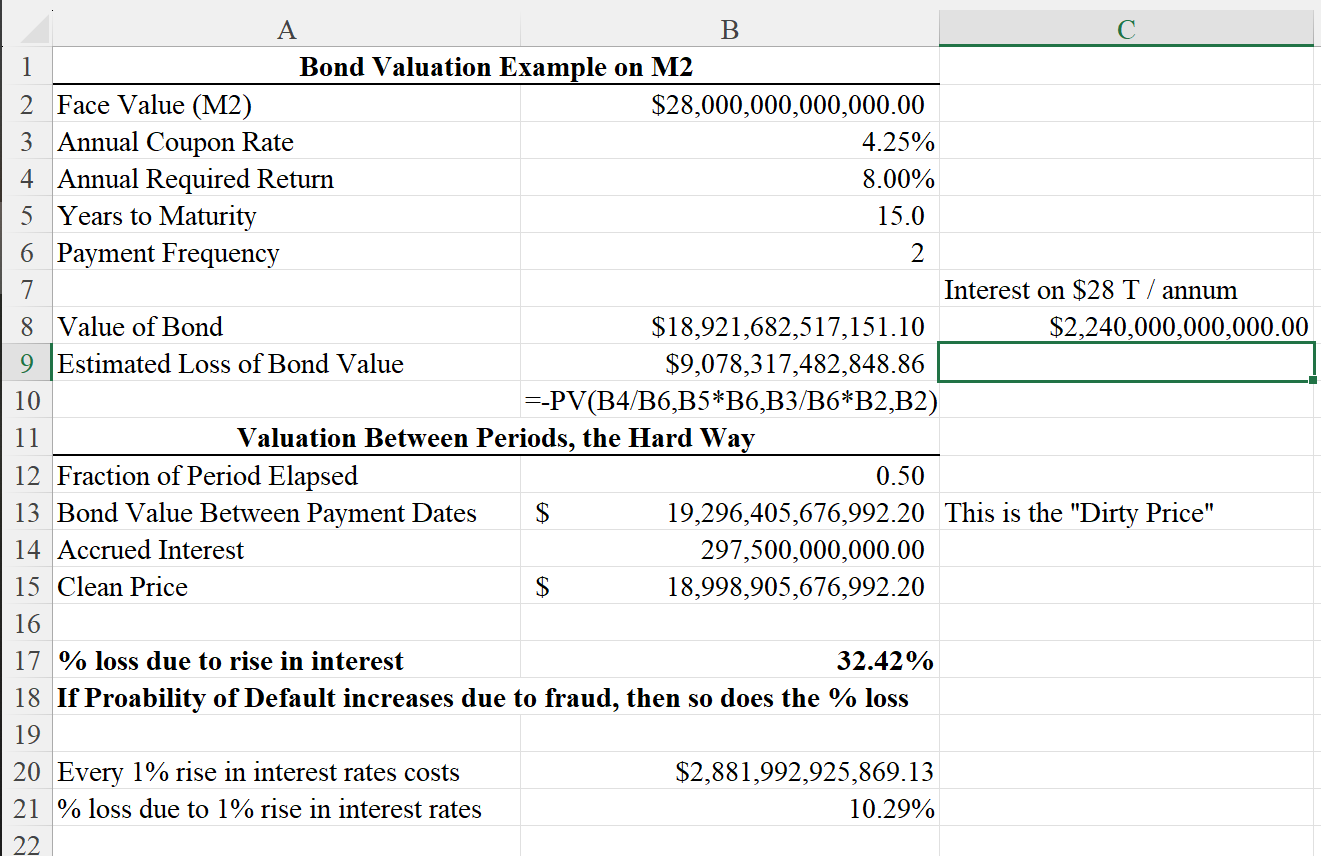

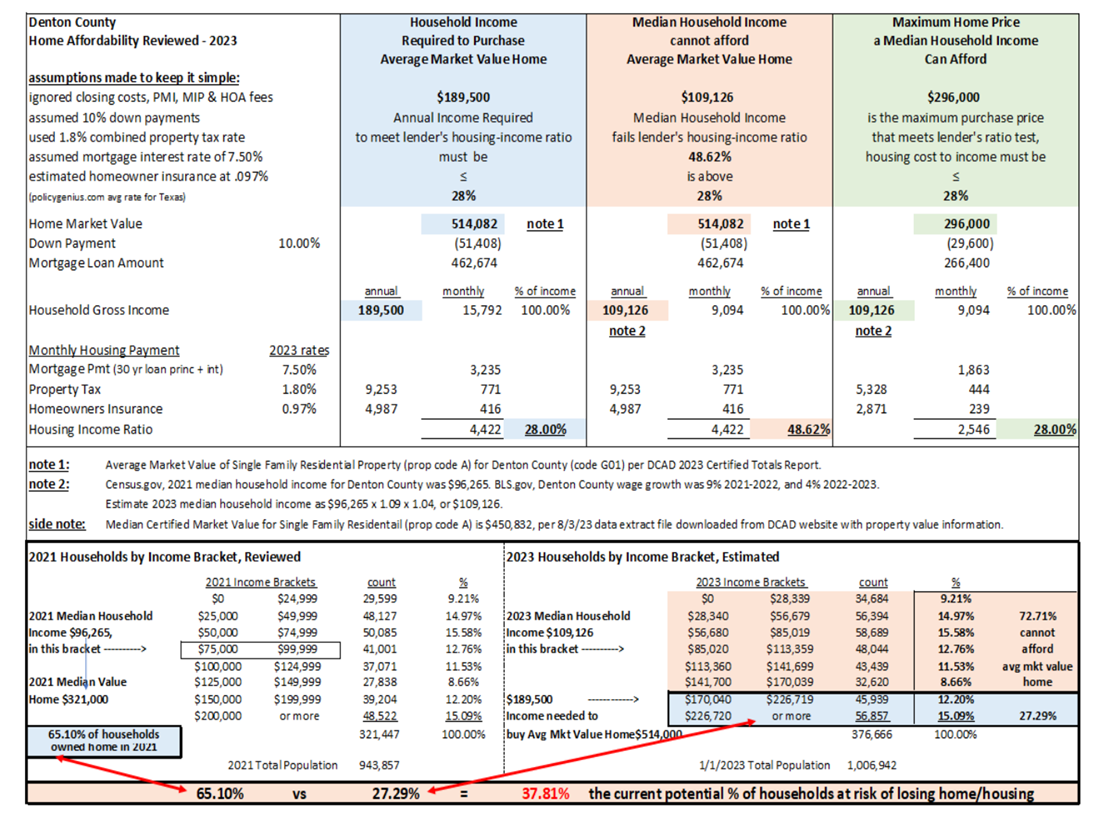

After having been approached by Mezz Funds, Preferred Equity, 221d4 financing, and Institutional Equity, patterns appear. From their presentations, to context of their speech, it becomes clear that each layer of additional financing, input, or perceived thought, the less the margin of safety for the equity investors. In layman’s terms, the more fingers in the pie, the less pie there is to eat. We created a spreadsheet quantifying the requirements of each of these various financing methods for different projects. For the most part, these institution’s perceptions are not aligned with the equity investors because they get their money from other institutions who may get their money from pension funds, based on promises that may not be deliverable. The net result in the Mezz and Preferred world are potential “Loan to Own” programs wherein a problem property (created by too many layers) can be taken over and the underlying equity position wiped out. The net result in the 221d4 world is a string of requirements that drive the build cost up $12,000 - $15,000 per unit above conventional financing, plus increasing the cost of operating requirements, not to mention only being able to withdraw your money, two times per year conditional upon audited statements and approval of a bureaucratic figure. There are lots of deals that have been done with these methods, but as compared to conventional financing some of the idiosyncrasies of these funding methods are difficult to accept. The real question is how much more profit and how much larger would the Margin of Safety have to be, but for the increased cost of satisfying the additional fingers in the pie? Further, what are the additional risks these participants bring to the table? In most instances, the third party and counter party risks outweigh the benefit of simply raising the appropriate amount of equity from parties whose true interest is aligned with the success of the project.

It is vitally important that all the participants in the project have their interests aligned with the success of the project. Institutions hire Analysts, to help screen projects. My experience has been that these Analysts are young, improperly trained, look for projects that they “believe” fit the corporate model, and know nothing about a margin of safety and quantifiable probability. They go from meeting to meeting, completely oblivious to the math that underlies the very property they are focused on, all while reading packaged market studies without the ability to quantify the data within the reports or ever realizing that the reports are mostly an average of an average. An Analyst can conjure up any story they want, and the executives, who have not done the research themselves, don’t even know what questions to ask of the Analyst so that there is a double check to the benefit of the company and its investors. Unfortunately, they have been trained to be parrots without the benefit of intellect. It is not the young Analysts fault. I have never met an Analyst who has built, or managed an investment. It is bad training put forth by the board of the company or senior leadership. Unfortunately, this is the norm. The Board uses the Analyst as a vehicle of plausible deniability. “it’s not my fault, the Analysts said it was ok.” “It is not my fault, the Appraisal says it is ok”. The Analyst who thinks he is smart, sees the ploy and simply says no to everything that does not check the box, in order to maintain his job. The investors are the people that lose but they don’t know what happened or why. It is not what the Analyst says yes to, as that has its own agenda. It is what he says no to that may in fact be the better investment that the company executives don’t see or understand, and the investors never see. The Analyst can’t discern between a diamond in the rough, and a project with the probability of low or no returns. Eventually, this nonsense will catch up with the company, but it will be at the expense of the various equity investors. When the tide pulls out, you get to see who is wearing clothes. The company, board and analyst are not aligned amongst themselves, let alone with their investors, and thus not with the potential success of the project

Math, not ego. It is very easy to draw a line between the participants and realize that they are mostly driven by ego and “belief.” This is the exact reason why, everybody at Mockingbird is purposefully dependent on statistics and quantitative finance. Every level of the spreadsheet, in coordination with the Architectural and Civil Design, from Construction Cost, Income, Expenses, Financing, Deal Structure Waterfall, are analyzed at each level and then jointly, in order to plan a project that has a good margin of safety, and a quantifiable reasonable expectation of profit and where all the participants of the project are in unison with success of the project. We have always taken the position that we don’t care what anybody in the industry does because they have not taken the time to understand what they are looking at and simply repeat what they think they know. The most basic questions of if things change can we adapt, and do we have the most viable design to stand the test of time in the marketplace, are seldom if ever asked. If a developer/syndicator wants to overpay for an urban project, prepare a pretty package that looks good on the corporate website and brochure, to attract the unsuspecting investor, then that is the spider web they wish to weave. Many are very good promoters. However, looking past the glitz to the probability of returns is what a smart investor would do. To survive over the long haul, math/probability over ego wins. Large corporations have the perceived benefit of size, but intellect will win over size. The old saying of “the bigger they are the harder they fall” is very relevant in todays over valued market environment. Bigger is not always better, but smarter is always smarter. Institutions building on a 5 cap (5% ROI) on a multifamily project is happening in 2021. What the investor in these low yield projects does not realize is that the probability of profit on a 5 cap is approximately 45%. One mistake or several smaller mistakes during construction can decimate the 5 cap. These are very poor odds because the margin of safety is not there. It is better to build wholesale than acquire at retail+. It is better to create adaptive reuse than acquire at retail+. Math, not ego.